XRP ($3.13) Could Hit New Heights in 2025″ decoding=”async” srcset=”https://bravenewcoin.com/wp-content/uploads/2025/01/BNC-Jan-24-6-200×114.jpg 200w, https://bravenewcoin.com/wp-content/uploads/2025/01/BNC-Jan-24-6-300×171.jpg 300w, https://bravenewcoin.com/wp-content/uploads/2025/01/BNC-Jan-24-6-400×228.jpg 400w, https://bravenewcoin.com/wp-content/uploads/2025/01/BNC-Jan-24-6-600×343.jpg 600w, https://bravenewcoin.com/wp-content/uploads/2025/01/BNC-Jan-24-6-768×438.jpg 768w, https://bravenewcoin.com/wp-content/uploads/2025/01/BNC-Jan-24-6-800×457.jpg 800w, https://bravenewcoin.com/wp-content/uploads/2025/01/BNC-Jan-24-6.jpg 825w” sizes=” 300px) 100vw, 300px”>

XRP ($3.13) Could Hit New Heights in 2025″ decoding=”async” srcset=”https://bravenewcoin.com/wp-content/uploads/2025/01/BNC-Jan-24-6-200×114.jpg 200w, https://bravenewcoin.com/wp-content/uploads/2025/01/BNC-Jan-24-6-300×171.jpg 300w, https://bravenewcoin.com/wp-content/uploads/2025/01/BNC-Jan-24-6-400×228.jpg 400w, https://bravenewcoin.com/wp-content/uploads/2025/01/BNC-Jan-24-6-600×343.jpg 600w, https://bravenewcoin.com/wp-content/uploads/2025/01/BNC-Jan-24-6-768×438.jpg 768w, https://bravenewcoin.com/wp-content/uploads/2025/01/BNC-Jan-24-6-800×457.jpg 800w, https://bravenewcoin.com/wp-content/uploads/2025/01/BNC-Jan-24-6.jpg 825w” sizes=” 300px) 100vw, 300px”>With a price surge of over 46% since the start of 2025, XRP’s momentum shows no signs of slowing.

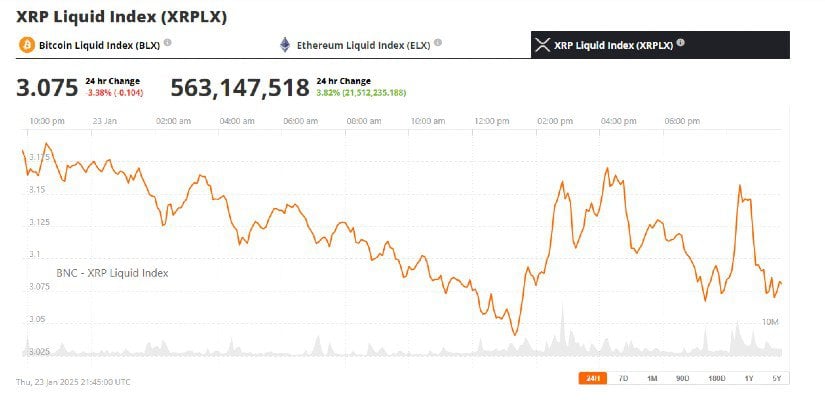

At the time of writing, XRP is trading at $3.07, marking a 3.38% decline in the last 24 hours, according to Brave New Coin’s XRP Liquid Index.

XRP is holding strong above $3. Source: Brave New Coin’s XRP Liquid Index.

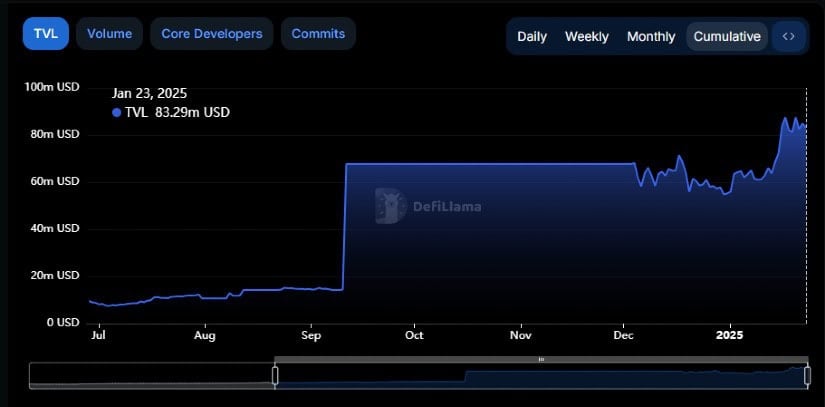

At the heart of XRP’s rapid growth is the expansion of the XRP Ledger network. According to DeFi Llama, the total value locked (TVL) in its decentralized finance ecosystem has climbed to an all-time high of $83.29 million. That rising TVL signals increasing user engagement and confidence in the ecosystem.

Rising TVL, Source: DeFi Llama

Adding to its bullish outlook, Ripple USD (RLUSD), a token closely tied to the XRP ecosystem, has been attracting robust trading activity. RLUSD’s daily trading volume recently hit over $160 million, a strong indication of active investor participation. Although its market cap remains modest at $52 million, the growing liquidity highlights its rising prominence in the market.

ETF Hopes and Technical Strength Propel Optimism

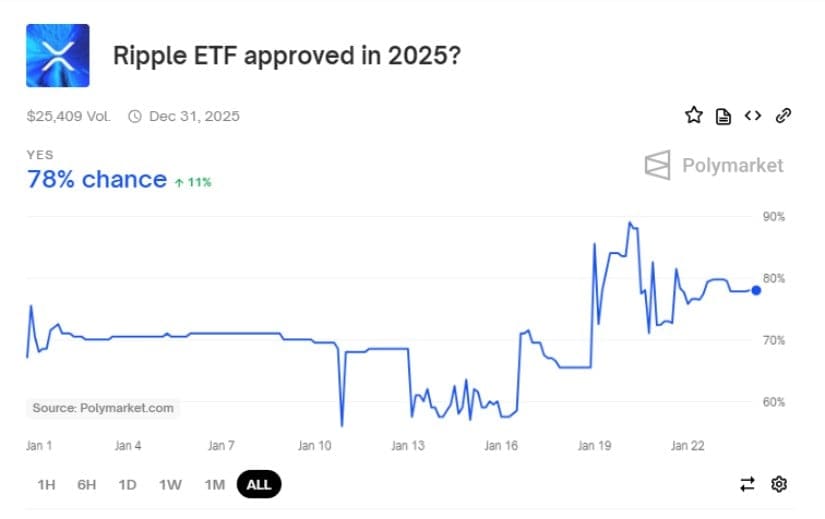

One of the most anticipated developments for XRP in 2025 is the potential approval of multiple XRP exchange-traded funds (ETFs) by the U.S. Securities and Exchange Commission. Companies like Bitwise, WisdomTree, and ProShares have already submitted applications, and market sentiment remains positive. Polymarket users currently estimate a 78% chance that the SEC will greenlight at least one XRP ETF this year.

The odds of a Ripple XRP ETF are rising. Source: Polymarket

Beyond institutional interest, XRP’s technical indicators point to further gains. The cryptocurrency recently broke above a bullish pennant pattern, which typically signals the potential for extended upward momentum. This breakout coincides with XRP reaching a critical resistance level identified by the Murrey Math Lines (MML) tool, which uses mathematical formulas to pinpoint key price barriers.

Source: Trading View

Analysts suggest that XRP’s next target could be an extreme overshoot level of 4 on the MML scale. The technical setup reinforces a positive long-term trajectory supported by the 50-week and 100-week moving averages, along with a robust Average Directional Index (ADX ($0.17)). XRP’s recent price rally, which saw the token rise 430% over the past six months, has cemented its place as one of the year’s standout performers.

U.S. Crypto Reserves Could Fuel Further Growth

XRP’s explosive growth has been partly tied to the outcome of the recent U.S. presidential election. Former President Donald Trump’s victory in November 2024 spurred optimism across the crypto sector, including for Ripple. Trump’s administration is expected to push for lighter regulations, creating a friendlier environment for cryptocurrencies.

President Trump has signed a significant Crypto Executive Order to bolster the United States’ leadership in digital finance. This order establishes the Presidential Working Group on Digital Asset Markets, tasked with developing a comprehensive federal regulatory framework for digital assets, including stablecoins. The group will also explore creating a strategic national digital assets stockpile to enhance U.S. competitiveness in this rapidly evolving sector.

Chaired by White House AI & Crypto Czar David Sacks, the Working Group includes senior officials such as the Secretary of the Treasury and the Chairman of the Securities and Exchange Commission (SEC). The order directs federal agencies to identify and amend existing regulations that may hinder innovation and growth in the digital asset space. Notably, it prohibits federal agencies from pursuing actions related to the establishment or promotion of Central Bank Digital Currencies (CBDCs), citing concerns over individual economic liberty and privacy. Additionally, the order revokes previous directives that the administration believes have impeded U.S. innovation in digital finance.

This move underscores the administration’s commitment to positioning the U.S. as a global leader in digital finance by fostering innovation and removing barriers to growth. By engaging top private-sector experts, the initiative aims to keep the U.S. ahead in the rapidly evolving digital asset market.

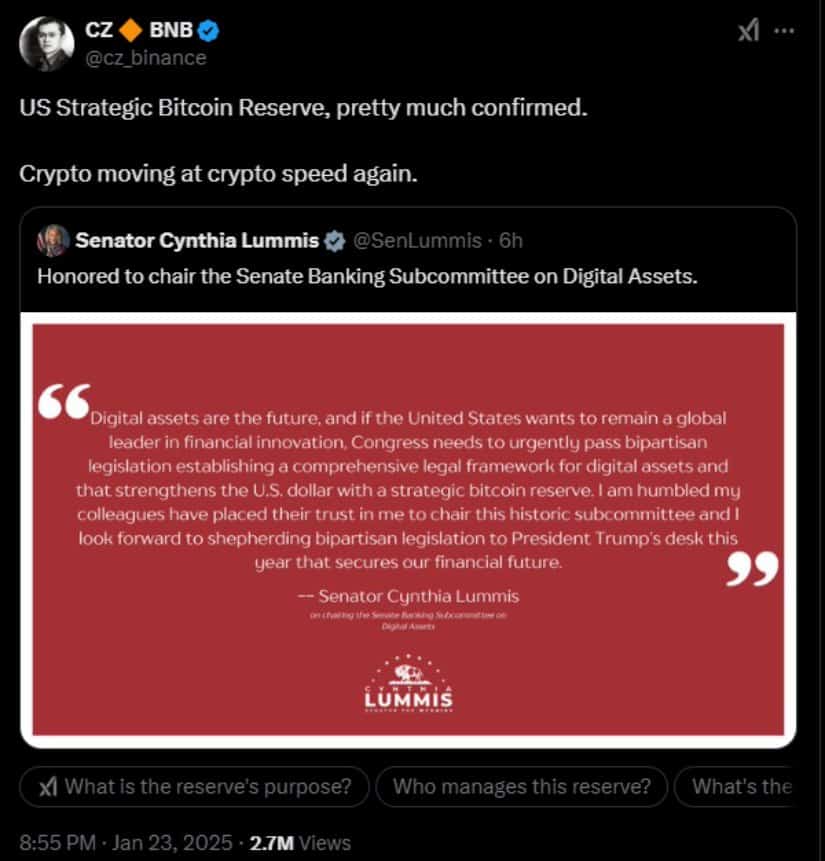

As confirmed by CZ, Trump’s plan to establish a U.S. strategic cryptocurrency reserve has sparked speculation about XRP’s role in that initiative. While the project was initially envisioned as a Bitcoin reserve, insiders suggest that the president is exploring the inclusion of U.S.-based cryptocurrencies like XRP and Solana.

Source: CZ

Ripple’s legal troubles with the SEC have long loomed over the token’s growth. However, there are signs of progress that could clear the path for further gains. With Trump’s pick, Mark Uyeda is expected to lead the SEC, and industry insiders believe there is a strong chance the securities violation case against Ripple Labs could be dropped.

Regulatory clarity would provide a substantial boost to investor confidence, helping solidify XRP’s position as a leading cryptocurrency. The token’s resilience, coupled with its expanding ecosystem and favorable market trends, paints a promising picture for the months ahead.

![Best Crypto Presales to Buy in October 2024 [The Next x1000] Best Crypto Presales to Buy in October 2024 [The Next x1000]](https://i2.wp.com/alexablockchain.com/wp-content/uploads/2024/10/Best-Crypto-Presales-to-Buy-in-October-2024-The-Next-1000x.jpg?w=1200&resize=1200,0&ssl=1)