Gold producer Calibre Mining’s (TSX: CXB) (OTCQX: CXBMF) Valentine gold mine in Newfoundland and Labrador, Canada is expected to start producing gold by the second quarter. Once that happens, it should easily catapult Calibre Mining’s valuation to mid-tier gold status.

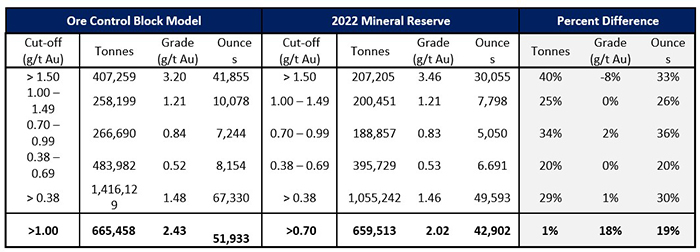

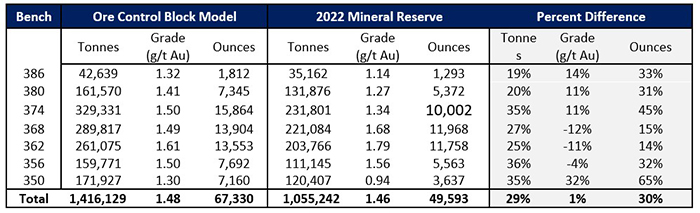

Even better, the results of recent Calibre Mining drilling demonstrate 29% more ore tonnes at a 1% higher grade for 30% more gold than the comparable area in the 2022 Mineral Reserve model at an ore-waste cut-off of 0.38 g/t gold, according to the company. Again, that’s significant and could easily drive Calibre Mining’s stock.

Making it even more attractive, the Valentine mine is one of the top mining jurisdictions in the world. It’s also expected to be the largest-known gold mine in Atlantic Canada. All of which is substantial news for Calibre Mining, and some of its top competitors, including Agnico Eagle Mines (NYSE: AEM) (TSX: AEM), Newmont Corporation (NYSE: NEM) (TSX: NGT), Franco Nevada Corp. (NYSE: FNV) (TSX: FNV), and Alamos Gold (NYSE: AGI) (TSX: AGI).

Calibre Mining’s (TSX: CXB) (OTCQX: CXBMF) Valentine Gold Mine Will Be Online in Q2

Calibre Mining Corp. announced additional ore control reverse circulation drill results from its Leprechaun open pit at Valentine Gold Mine in Newfoundland and Labrador, Canada. The Company has completed 21,500 metres of RC drilling on a 9 x 9 metre spacing. The results of this drilling demonstrate 29% more ore tonnes at a 1% higher grade for 30% more gold than the comparable area in the 2022 Mineral Reserve model at an ore-waste cut-off of 0.38 g/t gold.

Darren Hall, President and Chief Executive Officer of Calibre, stated: “I am very encouraged to report that Calibre’s Leprechaun open pit ore control drilling confirms grade and adds tonnage resulting in a 30% increase in contained gold compared to the Mineral Reserve. Importantly, the grade distribution as seen in Table 1 indicates that applying a higher cut-off grade will result in processing higher grade material. At a 0.70 g/t cutoff, the reserve model estimated 660kt at 2.02 g/t whereas the ore control model, for a similar tonnage, results in 18% higher grade by increasing the cutoff to 1.0 g/t. This is an extremely positive result which could result in increased metal production while simultaneously extending mine life.

I am also pleased to report that Valentine construction is going well, with strong progress on structural, mechanical, and piping activities in the grinding, reagents and gold room areas. Additionally, we have advanced pre-commissioning at the crusher and various e-rooms. There are no changes to Valentine’s fully funded initial project capital cost of C$744 million and we remain on track to deliver first gold during Q2 2025.”

Table 1 Ore Control Block Model vs 2022 Mineral Reserve by Grade (For benches 386 – 350)

Table 2 Ore Control Block Model vs 2022 Mineral Reserve by Bench (above 0.38 g/t, i.e. the ore / waste cutoff)

The tables above demonstrate the correlation between the ore control block model, supported by the closer spaced 9 x 9 metre drilling, and the 2022 Mineral Reserve Block Model from the Feasibility Study1. The comparison was carried out on 7.9 million tonnes of material extending from the current topography to bench 350 on blocks within 9 metres of RC drilling using 6 x 6 x 6 metre block sizes. For the 2022 Mineral Reserve Block Model, blocks flagged as Proven & Probable are reported. For the Ore Control Block Model, a similar method was used to delineate ore vs. waste, respecting a minimum mining width of six metres and a minimum grade of 0.38 g/t gold. The RC drilling is a component of the Company’s standard mining approach.

Other related developments from around the markets include:

Agnico Eagle Mines and O3 Mining Inc. announced that Agnico Eagle has taken-up and acquired 110,424,431 common shares of O3 Mining, representing approximately 94.1% of the outstanding common shares of O3 Mining on a basic basis, pursuant to its board-supported take-over bid for all of the outstanding Common Shares for $1.67 in cash per Common Share. The aggregate consideration payable for the Deposited Shares is $184,408,800. Agnico Eagle will pay for the Deposited Shares by January 28, 2025. All of the conditions of the Offer have been satisfied or waived. O3 Mining’s President and Chief Executive Officer, Mr. José Vizquerra commented: “We are pleased to achieve this excellent and timely outcome for our shareholders who tendered their Common Shares to the Offer. While providing an opportunity for our shareholders to realize immediate value at a significant premium, the transaction will also enable the efficient advancement of the Marban Alliance project by Agnico Eagle, an experienced operator that has the financial strength, mining expertise and community commitment to take the project to its next stage of development.”

Newmont announced that it has agreed to sell its Musselwhite operation in Ontario, Canada, to Orla Mining Ltd for up to $850 million in total consideration. Under the terms of the agreement, Newmont will receive cash consideration of $810 million upon closing and up to $40 million 1 in contingent payments. The transaction is expected to close in the first quarter of 2025, subject to certain conditions being satisfied. 2 Upon closing the announced transactions, Newmont will have surpassed its target of delivering more than $2 billion in gross proceeds from non-core divestitures.

Franco Nevada just noted, “Record gold prices generated higher revenues, Adjusted EBITDA and earnings in Q3 compared to Q2 2024,” stated Paul Brink, CEO. “GEO sales were stable compared to Q2 although lower compared to Q3 2023 without the contribution from Cobre Panama. The quarter benefitted from contributions from the newly commissioned Tocantinzinho mine in Brazil, and increased contributions from royalties from the recently completed Greenstone mine and the newly acquired Yanacocha royalty. Candelaria reported an increase in copper and gold production for the quarter. While Candelaria’s copper output is on track, Lundin Mining has revised its 2024 gold production guidance lower to reflect revised gold grades for the period. In addition, revenue from our Diversified assets translated into lower GEOs reflecting record gold prices. We have adjusted our 2024 guidance as a result. Franco-Nevada continues to benefit from higher gold prices with limited exposure to cost inflation. The company remains debt-free with substantial available capital and has a strong pipeline of potential precious metal streams and royalties.”

Alamos Gold reported fourth quarter and annual 2024 production. The Company also provided updated three-year production and operating guidance and announced a construction decision on the Lynn Lake project in Manitoba. “With the solid finish to the year, we met both our quarterly and increased annual production guidance. Production increased 7% from 2023 to a record 567,000 ounces and combined with strong margin expansion, we generated record revenues and free cash flow while investing in high-return growth,” said John A. McCluskey, President and Chief Executive Officer. “This investment in growth is expected to drive our production 24% higher over the next three years. We are also pleased to announce the start of construction on Lynn Lake, another attractive project that will provide additional growth into 2028. All of this growth is in Canada, it is lower cost, and it is all fully funded providing Alamos with one of the strongest outlooks and lowest political risk profiles in the sector. This growth is underpinned by high-quality, long-life assets with significant upside potential that we expect to continue to unlock with our largest exploration budget ever,” Mr. McCluskey added.

Legal Disclaimer / Except for the historical information presented herein, matters discussed in this article contains forward-looking statements that are subject to certain risks and uncertainties that could cause actual results to differ materially from any future results, performance or achievements expressed or implied by such statements. Winning Media is not registered with any financial or securities regulatory authority and does not provide nor claims to provide investment advice or recommendations to readers of this release. For making specific investment decisions, readers should seek their own advice. Winning Media is only compensated for its services in the form of cash-based compensation. Pursuant to an agreement Winning Media has been paid three thousand five hundred dollars for advertising and marketing services for Calibre Mining Corp. by Calibre Mining Corp. We own ZERO shares of Calibre Mining Corp. Please click here for disclaimer.

Contact:

Ty Hoffer

Winning Media

281.804.7972

[email protected]