Grayscale’s XRP ($2.74) ETF: The Next Big Play?

One of the biggest pieces of news shaking up the XRP market is Grayscale Investments’ recent application for an XRP exchange-traded fund (ETF). The SEC has officially acknowledged the application, which is a critical step forward. While this doesn’t mean approval is guaranteed, it signals that XRP is being taken seriously in the world of institutional finance.

Why does this matter? An ETF would allow traditional investors to gain exposure to XRP without directly holding the token. This could flood the market with institutional capital, boosting liquidity and price stability. The mere acknowledgment of the application has already sparked a significant price rally, with XRP jumping over 9% in a single day.

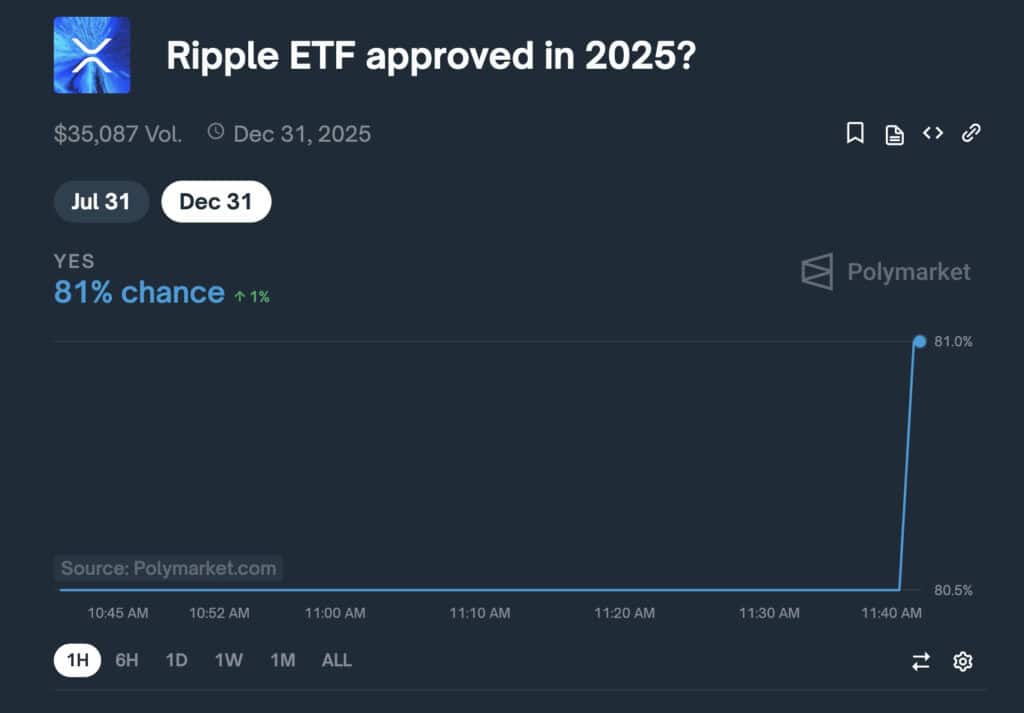

There’s an 81% chance of spot XRP ETF approvals in 2025, Source: Polymarket

Is XRP A Security? Uncertainty Lingers

The crypto community is buzzing with speculation about the U.S. Securities and Exchange Commission’s (SEC) stance on XRP. Recently, the SEC acknowledged applications for exchange-traded funds (ETFs) tied to XRP, sparking debates about whether XRP is now considered a commodity, similar to Bitcoin and Ethereum. However, the SEC hasn’t explicitly classified XRP as a commodity, leaving the matter open to interpretation.

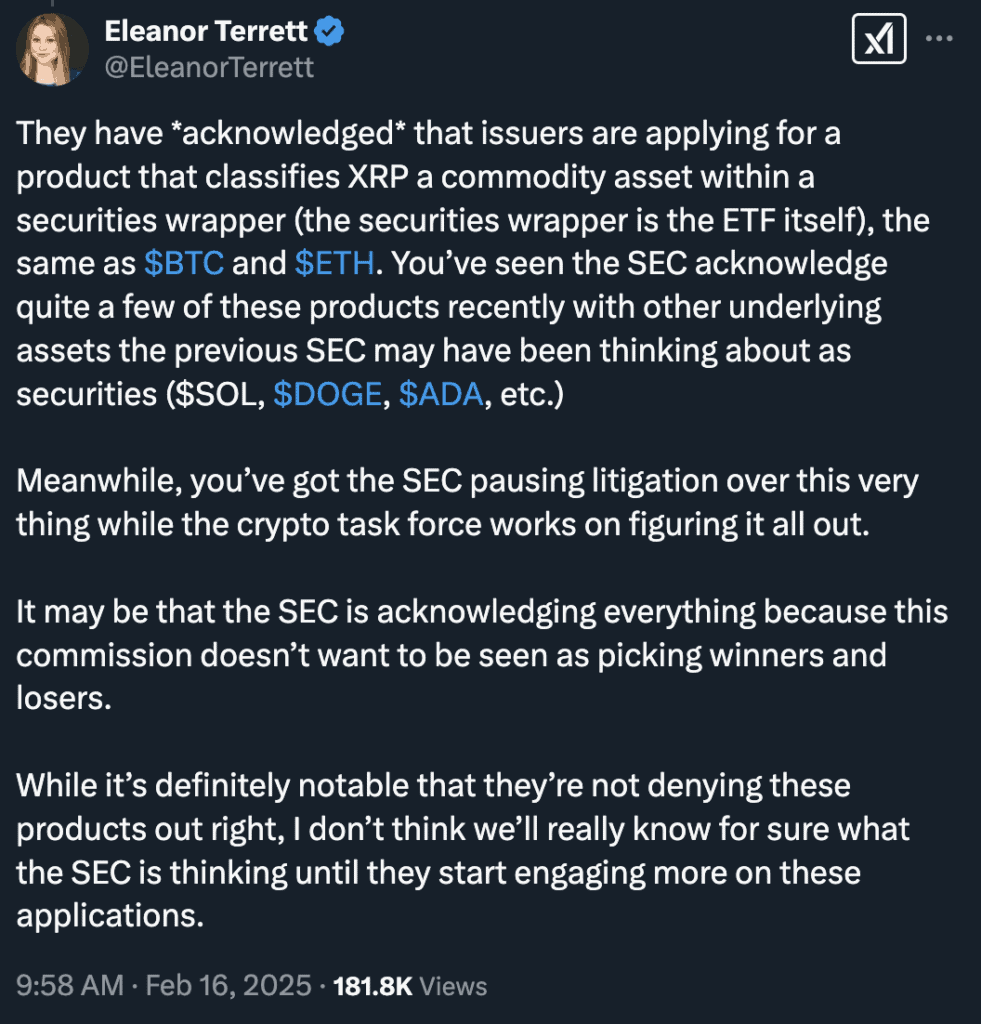

Crypto journalist Eleanor Terrett highlighted that the SEC’s acknowledgment suggests issuers view XRP as a commodity within a securities framework. She noted, “They have acknowledged that issuers are applying for a product that classifies XRP as a commodity asset within a securities wrapper.” Despite this, regulatory authorities have yet to provide definitive confirmation.

The SEC has acknowledged XRP ETF filings, classifying it as a commodity within a securities wrapper, like BTC ($96,914.67) and ETH ($2,666.47). Source: Eleanor Terrett via X

This development comes amidst Ripple Labs’ ongoing legal battle with the SEC, which began in 2020 over allegations that XRP was sold as an unregistered security. In a landmark ruling, a U.S. court determined that XRP is not a security in secondary market transactions, a decision seen as a win for the crypto industry. However, the court also ruled that Ripple’s direct institutional sales of XRP constituted unregistered securities offerings, leaving a gray area in its overall classification.

The SEC’s treatment of XRP may also influence broader regulatory cases against major crypto exchanges, including Binance and Coinbase. Both platforms have been under investigation for the sale of unregistered securities, and their court battles have been temporarily stayed by the SEC’s crypto enforcement task force. If XRP is ultimately classified as a commodity, it could set a precedent for how similar digital assets are treated.

Market observers believe that an official commodity status for XRP would significantly impact its adoption and price trajectory. Some speculate that such a classification could pave the way for institutional investment and push XRP’s valuation beyond $110 in the long term.

Gary Gensler’s SEC Exit: A Game Changer?

As if the ETF news wasn’t enough, another major shift is unfolding: Gary Gensler has stood down to be replaced by pro-crypto Paul Atkins. Gensler’s tenure was marked by aggressive regulatory scrutiny on crypto, leading to lawsuits against major players, including Ripple.

His resignation has ignited speculation that the SEC could adopt a more crypto-friendly stance. The change in leadership could have profound implications for Ripple, which has been locked in a prolonged legal battle with the SEC over whether XRP is a security. If the next SEC Chair takes a softer stance, Ripple could see regulatory clarity that has eluded it for years.

Ripple’s Website Redesign: A Subtle Shift in Strategy?

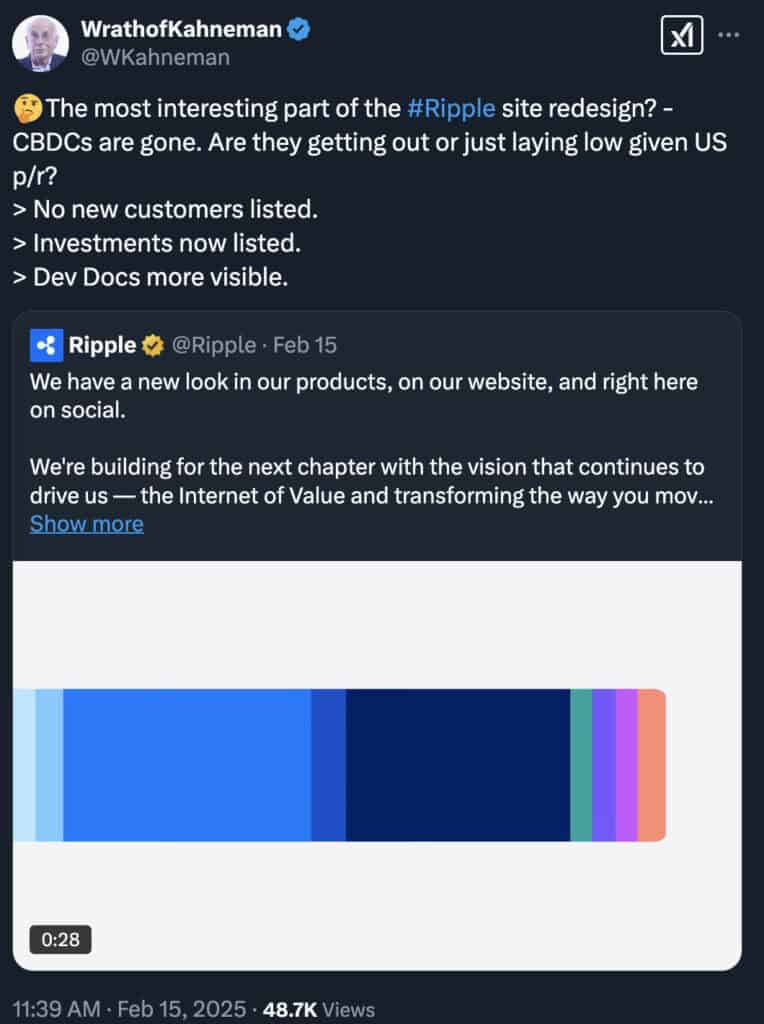

In another intriguing development, Ripple recently overhauled its website—and eagle-eyed community members quickly noticed something missing: any mention of Central Bank Digital Currencies (CBDCs). This omission has fueled speculation about whether Ripple is stepping back from its CBDC ambitions or simply shifting its focus.

Ripple has long been seen as a key player in the CBDC space, partnering with central banks on pilot programs. So why the sudden change? It could be a move to emphasize its payment solutions rather than its CBDC efforts, or it could signal a more fundamental strategic pivot. Either way, the XRP community is watching closely.

The website redesign has the XRP community watching closely, Source: X

What Does This All Mean for XRP?

Taken together, these developments suggest that 2025 could be a defining year for XRP. A Ripple XRP Spot ETF approval could bring a flood of new investment, a new SEC regime could reshape its legal standing, and Ripple’s evolving strategy could point to new directions for the company.

One thing’s for sure: XRP is at a crossroads. Whether the XRP price surges to new heights or faces fresh challenges depends on how these dominoes fall. But if recent events are any indication, the next few months are going to be anything but boring for XRP holders. Is it good XRP news? Or bad XRP news? Time will tell.

Watch – XRP Price Analysis Video

</div