The cryptocurrency market has turned into a bloodbath in the last 24 hours. Bitcoin and altcoins have experienced major declines in the last 24 hours.

BTC ($91,526.31) fell to $91,000, breaking key support levels. Analysts attributed the decline to a bearish market sentiment and a lack of catalysts that could support the market upwards.

With the selling wave, Bitcoin fell by up to 14% in the last 24 hours, while Ethereum (ETH ($2,491.25)) fell by 8%; Solana (SOL ($140.06)) by 11.6%; XRP ($2.26) by 7.7% and Dogecoin (DOGE ($0.21)) by 8.8%.

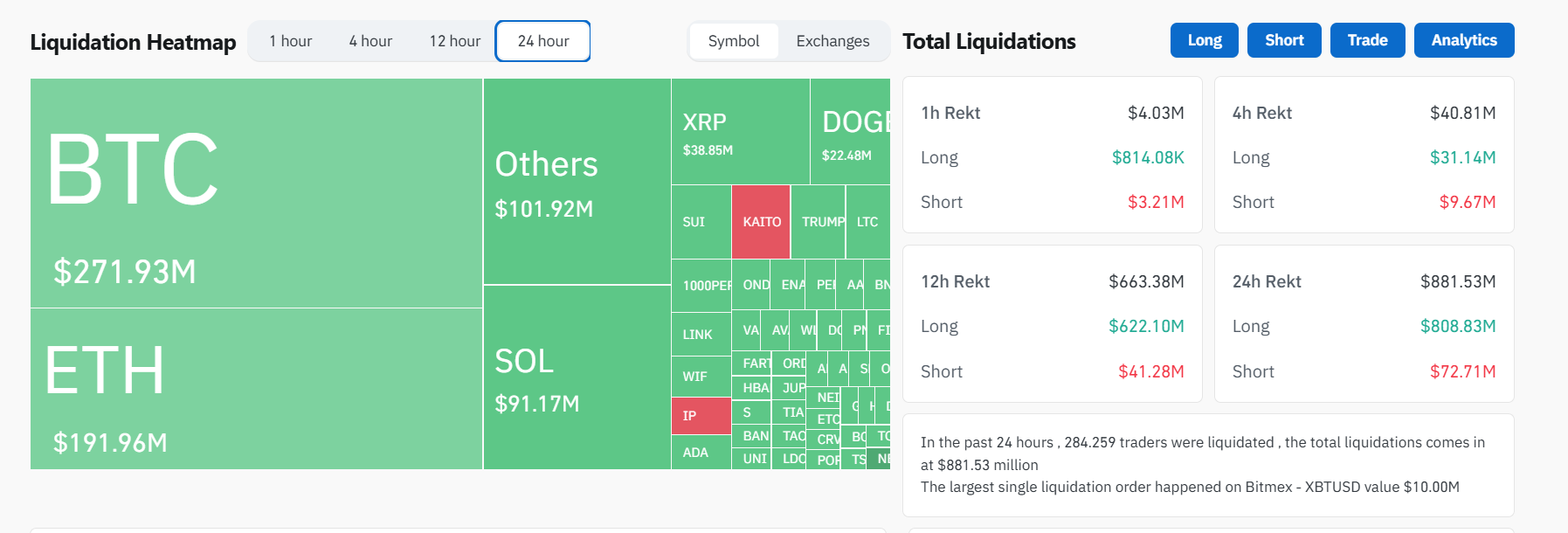

This decline left investors with leveraged positions in a bind. According to Coinglass data, $881 million worth of leveraged positions were liquidated in the last 24 hours. $808 million of this was long positions and $72.7 million was short positions.

The largest liquidation occurred in Bitcoin, followed by Ethereum, Solana, XRP and DOGE.

While 284,278 investors liquidated in the last 24 hours, the largest liquidation occurred in the XBT/USD trading pair on Bitmex.

Analysts Commented on the Fall in Bitcoin, Warned!

This sharp decline in Bitcoin and altcoin prices has made investors nervous, while analysts warn of the possibility of further corrections. At this point, CryptoQuant research head Julio Moreno pointed out that Bitcoin demand has fallen into negative territory for the first time since September 2024.

Moreno argued that Bitcoin’s current market conditions continue to struggle, with demand falling into negative territory, making it difficult for the BTC price to recover. The analyst also warned that the risk of further corrections is also increasing.

Experienced cryptocurrency analyst Ali Martinez also evaluated the latest situation of Bitcoin and the decline.

If BTC bulls fail to hold the $93,700 support at the daily close, the analyst said, there is a risk of the price falling to the next major support at $75,600.

Jeff Mei, COO of crypto exchange BTSE ($0.59), attributed the declines to inflation concerns and the Fed’s pause on rate cuts, and noted that the situation could change soon: “Bitcoin, Ethereum, and Solana should not be trading this far below their all-time highs. On the US side, inflation concerns and the pause in Fed rate cuts have kept markets down, but that could change as weak economic data released last week could prompt Fed officials to take further action.”

Bitcoin continues to trade at $91,750 at the time of writing.

*This is not investment advice.

Continue Reading: Bitcoin (BTC) and Altcoins Are Falling Again! Will the Fall Continue? Analysts Commented! creator solana token