Leading cryptocurrency Bitcoin (BTC ($99,970.99)) and altcoins started the critical week with a decline. BTC experienced a significant decline ahead of the Fed’s interest rate decision to be announced this week.

Bitcoin (BTC) price fell to $100,000 levels today, while Ethereum (ETH ($3,125.12)), XRP ($2.92), olana (SOL ($230.90)) and Dogecoin (DOGE ($0.32)) fell between 5% and 10%.

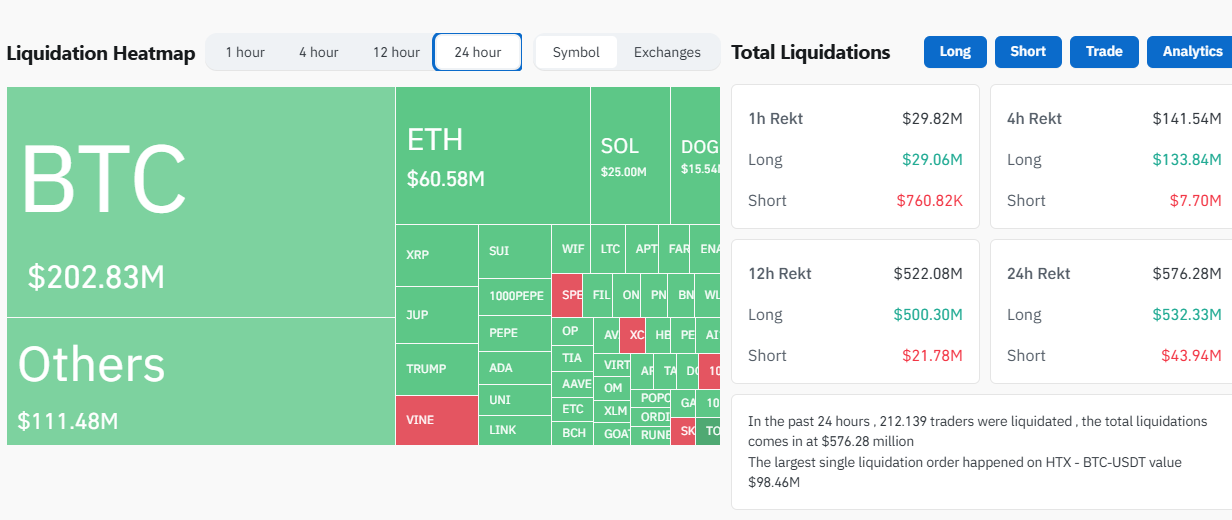

This decline also left investors in leveraged transactions in a bind, with $576 million in liquidations in the last 24 hours, according to Coinglass data.

Of this, $532 million consisted of long positions and $43.9 million consisted of short positions. While 212,139 investors liquidated in the last 24 hours, the largest liquidation occurred in the BTC/USDT ($1.00) trading pair on HTX.

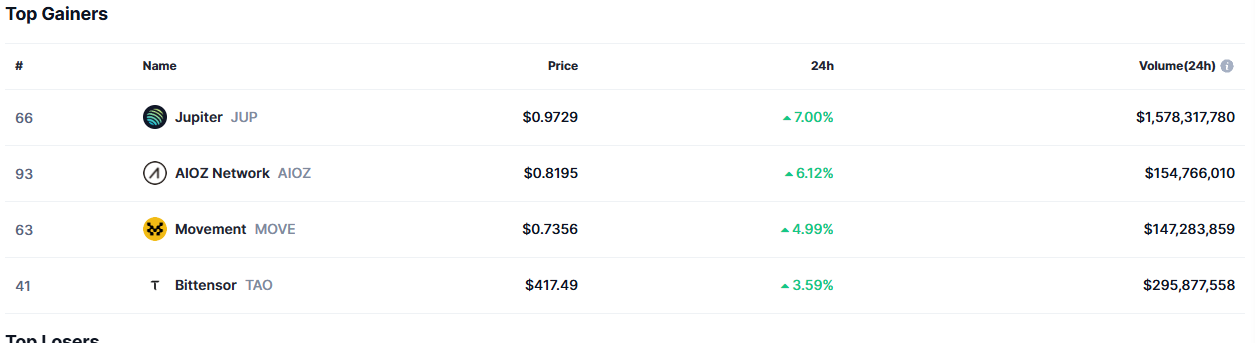

Only Four Altcoins Are On The Rise!

While BTC and altcoins in general have declined in the last 24 hours, only four altcoins have seen positive returns. Accordingly, Jupiter (JUP ($0.96)) increased by 7%; AIOZ ($0.81) Network (AIOZ) by 6%; Movement (MOVE) by 4.9% and Bittensor (TAO) by 3.5%.

What is the reason for the decline?

While the reason behind this sudden decline is being wondered, experts said that Bitcoin experienced a decline due to profit sales by investors despite the support given by US President Donald Trump.

“While the market got 90% of what it wanted with Donald Trump’s executive orders, it was already priced in. Anything short of a Bitcoin reserve that immediately started buying BTC was going to be disappointing. At that point, investors who bought the expectations took profits after expectations and the price fell,” Sean McNulty, head of derivatives at FalconX APAC, told Bloomberg.

Experts also state that the uncertainty regarding the FED interest rate decision to be announced this week has also negatively affected the market and triggered the decline in Bitcoin.

*This is not investment advice.

Continue Reading: Bitcoin (BTC) and Altcoins Started the Critical New Week with a Decline! So What is the Reason for the Decline?