The cryptocurrency market has seen a modest rise over the past 24 hours, with total market value exceeding $3.3 trillion. The increase came as market participants digested the minutes of the January meeting of the Federal Reserve, which highlighted concerns about inflationary pressures from proposed tariffs and immigration policies.

The Federal Open Market Committee cited the need for “more progress on inflation” before considering any rate cuts and instead opted to keep the federal interest rate at 4.25%-4.50%.

Bitcoin has gained around 3% in the past day, climbing modestly to near $98,400. However, it remains in a consolidation phase, trading in a broad range between $93,000 and $100,000.

Nexo Dispatch analyst Iliya Kalchev said the following about the current state of Bitcoin in his statement:

“Market participants should closely monitor the Fed’s policy direction as these developments are likely to impact liquidity and investor sentiment. Bitcoin’s ability to hold the $92,500 support level will be crucial in determining its near-term trajectory. Additionally, Ethereum’s Pectra upgrade and the evolving regulatory environment for crypto ETFs warrant attention as they could introduce new dynamics into the market.”

Related News: Is the Current Bitcoin Price Cheap or Expensive? Analytics Company Shares Its Special Metric

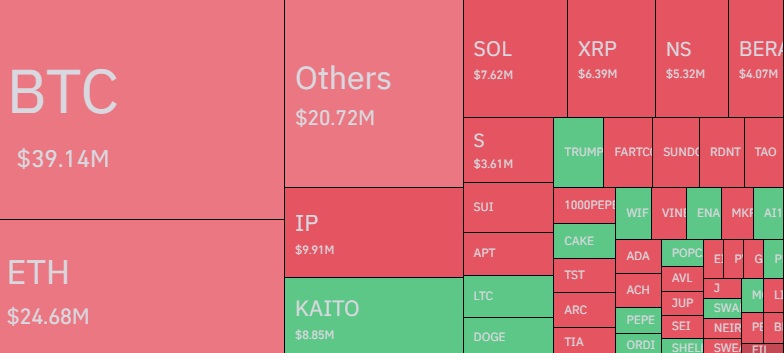

When we examine the liquidation data, we see that a total of $174 million worth of cryptocurrencies were liquidated in the last 24 hours. $118 million of these were observed in short positions, while the rest were in long positions. When we examine the assets, we see that the cryptocurrencies that were liquidated the most were BTC ($98,608.21), ETH ($2,750.39), IP, KAITO and SOL ($176.74), respectively.

Table showing the most liquidated assets in the cryptocurrency market in the last 24 hours.

Table showing the most liquidated assets in the cryptocurrency market in the last 24 hours.*This is not investment advice.

Continue Reading: Bitcoin is Recovering – What’s Driving the Rise? What is the Latest Liquidation Data?