Bitcoin (BTC ($86,289.17)) has fallen to levels not seen since November in the last 24 hours. While the BTC price has fallen to $83,000, the situation is no different for altcoins.

Altcoins continue to be far from their peaks, while the index measuring overall sentiment in the cryptocurrency market has fallen to its lowest level in more than two years.

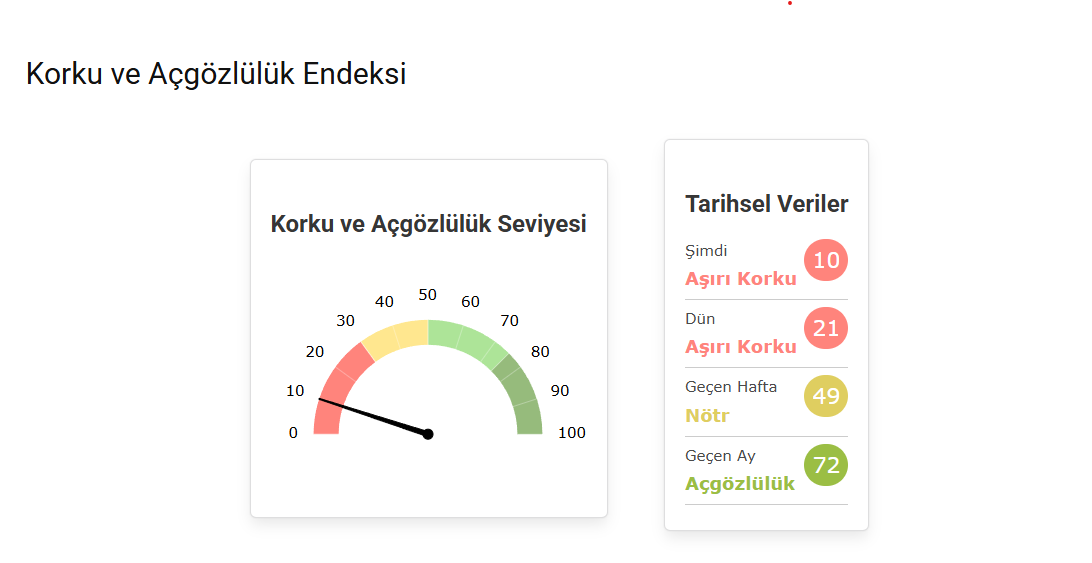

The Crypto Fear & Greed Index, a key index that tracks Bitcoin and cryptocurrency sentiment, has reached even lower levels than the FTX ($0.00) crash.

What is the Fear and Greed Index?

Extreme fear can be a buying opportunity as it indicates that people are very anxious and the price has bottomed out.

Excessive greed could mean that there is a correction in the market.

This data, which analyzes the current sentiment of the Bitcoin market, is displayed on a simple scale from 0 to 100. Zero represents “extreme fear” while 100 represents “extreme greed.”

Market analysts say investors should not panic sell, saying now is not the time to sell because conditions of extreme fear often underlie upward price movements.

Analysts said that Bitcoin has been testing its 200-day moving average (DMA) in the recent decline, while the Relative Strength Index (RSI) indicator, which is often used to predict ups and downs, has fallen into oversold territory.

Analysts note that this data reflects a favorable environment for BTC to gain bullish momentum and experience a potential recovery.

When looking at historical data, it is seen that those who bought fear were the winners during periods when fear fluctuated between 10-20 points. At this point, will investors who generally act with the principle of “Buy fear, sell greed” be right again? Time will tell.

Don’t Panic Sell!

Collective Shift founder Ben Simpson said that the current market conditions present a buying opportunity for crypto investors, noting that the Crypto Fear & Greed Index has fallen to extreme fear levels.

Stating that panic selling should not be done in Bitcoin and altcoins, Simpson explained the simple strategy that investors should follow.

“The simple strategy employed over the last few years has been to buy in times of extreme fear and sell in times of Greed.

If you did that, you’ve outperformed the market and probably most investors.”

Simpson explained that the negative sentiment in cryptocurrencies is due to the failure to meet high expectations for the inauguration of US President Donald Trump: “There’s not much to be hopeful or excited about right now. Everyone was counting on Donald Trump to make big moves for Bitcoin and crypto, but he’s busy with other things right now.”

Wait for March!

Swyftx chief analyst Pav Hundal noted that the extreme sense of fear in the market is temporary and said investors should be patient.

“The next few weeks may be challenging for Bitcoin and altcoins, but global liquidity levels are increasing every week.

“Historically, this is a leading indicator for Bitcoin’s recovery and rise. March is expected to be a pivotal month.”

*This is not investment advice.

Continue Reading: Extreme Fear Dominates Bitcoin and Altcoins! Should We Buy Fear? What Do Historical Data and Analysts Say? creator solana token