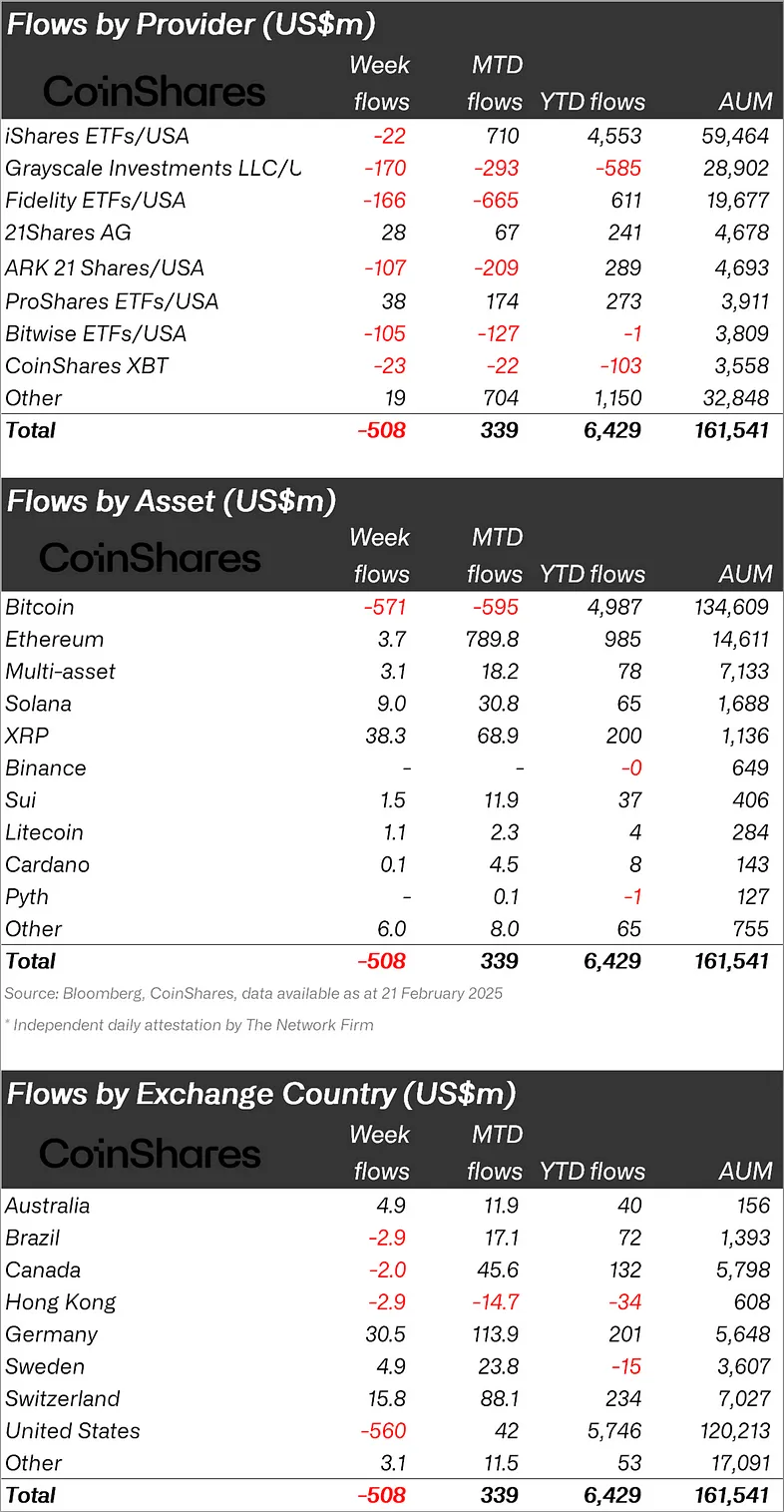

While the Bybit hack incident, in which $1.4 billion worth of Ethereum (ETH ($2,671.22)) was stolen, continues to be discussed, Coinshares published its weekly cryptocurrency report and said that $508 million outflow occurred last week.

“Cryptocurrency investment products saw a total outflow of $508 million as investors turned cautious following the US Presidential inauguration and uncertainties around trade tariffs, inflation and monetary policy.”

While Bitcoin is Experiencing an Uptrend, Altcoins Are Also Introducing!

When looking at individual crypto funds, it was seen that the majority of outflows were in Bitcoin.

While BTC ($95,510.91) experienced an outflow of $571 million, Ethereum (ETH) experienced a small inflow of $3.7 million.

When we look at other altcoins, the picture is positive, with XRP ($2.45) experiencing an inflow of $38.5 million, Solana (SOL ($155.87)) $9 million, and Sui (SUI ($3.21)) $1.5 million.

“Bitcoin was the main focus with $571 million outflow, some investors chose to add short positions and the short Bitcoin fund also saw $2.8 million inflow.

Interestingly, altcoins continued to see inflows, with XRP once again taking the lead with $38.3 million inflows.

XRP has seen $819 million in inflows since mid-November 2025, reflecting investors’ hopes that the SEC will drop its case.

Solana, Ethereum, and Sui followed XRP with inflows of $8.9 million, $3.7 million, and $1.47 million, respectively.”

When looking at regional fund inflows and outflows, it was seen that the USA ranked first with an outflow of 560 million dollars.

After the US, Hong Kong and Brazil experienced small outflows of $2.9 million.

Contrary to these outflows, Germany and Switzerland experienced inflows of $30.5 million and $15.8 million, respectively.

*This is not investment advice.

Continue Reading: Institutional Investors Are Falling in Bitcoin, Rise in Altcoins! “Four Altcoins Made a Difference!” creator solana token