The crypto news cycle is worsening as meme coins suck the market dry. Speaking publicly for the first time, Milei distanced himself from accusations of market manipulation. He insisted that his social media promotion of the token wasn’t an endorsement for investment but rather an effort to highlight a crypto-based initiative aimed at supporting Argentine entrepreneurs.

“I’m not a crypto expert,” Milei told Todo Noticias in a Monday night interview. “My expertise is economic growth, with or without money. As someone passionate about technology and its potential to fund projects, I simply shared the idea.”

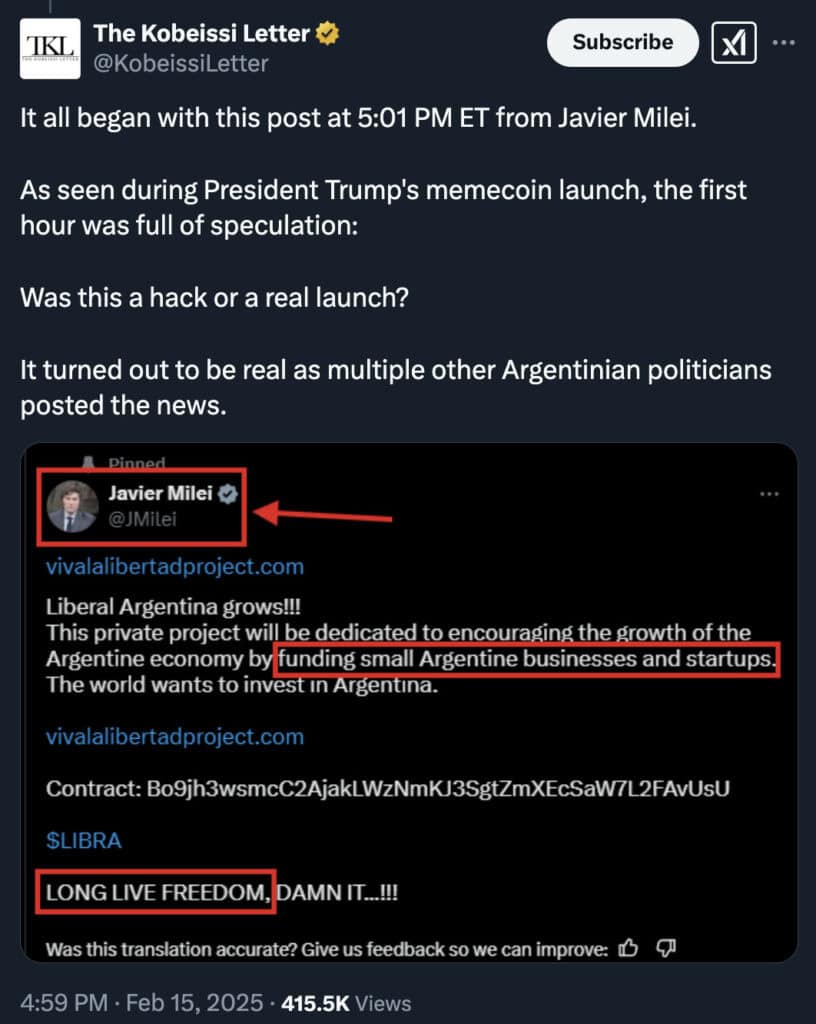

Yet, his endorsement—intentional or not—set off a speculative frenzy. On Friday night, after Milei directed his massive online following to the Libra token, its price quadrupled within hours, briefly pushing the market cap to an eye-watering $4 billion.

Milei’s deleted X post. Source: Kobeissi Letter

Then came the inevitable crash, leaving retail traders in the red and fueling allegations of a pump-and-dump scheme.

LIBRA chart, what goes up, must come down. Source: DEX Screener

Political Fallout: Milei Under Fire

The scandal has handed Milei’s opponents fresh ammunition. His government, which initially remained silent, has now launched an internal probe. Meanwhile, opposition leaders have seized on the turmoil, attempting to frame it as the worst crisis of his administration—though impeachment remains a long shot, given the two-thirds majority required in Congress.

The president, while acknowledging the gravity of the situation, admitted that his open-door approach to economic solutions might need revision.

“The biggest lesson? I can’t keep being the same Javier Milei as always,” he conceded. “Sadly, I need to start filtering who gets access to me.”

Economy Minister Dismisses ‘Tiny’ Crypto World

As pressure mounted, Economy Minister Luis Caputo was the first to break the government’s silence Monday evening, attempting to downplay the incident as a niche misunderstanding rather than outright misconduct.

“Cryptocurrencies are a tiny, infinitesimal world. It’s a specialist domain that’s incredibly difficult to grasp,” Caputo stated. “I don’t understand crypto either, and it’s been explained to me 800,000 times.”

Despite his attempts to reassure investors, markets weren’t convinced. The S&P Merval Index suffered its biggest one-day drop since July, plummeting 5.6% as Buenos Aires traders dumped shares in top Argentine firms.

Social Media Spin: Chainsaws and Trump’s Endorsement

While political and financial damage control continued, Milei’s team tried to shift public focus. On social media, the presidential account touted Argentina’s budget surplus and highlighted Milei’s meeting with US Senator Steve Daines. The president also posed with a chainsaw—a now-iconic symbol of his austerity drive—and reshared a post from Donald Trump, reinforcing his ties to the former US president.

In November 2024, Milei met with Donald Trump and Elon Musk at Mar-a-Lago ahead of the CPAC Investor Summit, marking Trump’s first meeting with a foreign leader after his November 5 election victory.

During the event, Milei praised Trump’s win, declaring it a victory for liberty and condemning tax systems as forced wealth redistribution. He also commended Musk, who was set to lead Trump’s Department of Government Efficiency, for his role in advancing free speech through X (formerly Twitter).

Since taking office in December 2023, Milei has aggressively cut Argentina’s government, reducing ministries from 24 to 8, laying off 25,000 public workers, slashing the federal budget by 30%, and privatizing state enterprises like Aerolíneas Argentinas and Intercargo, aligning with his libertarian vision of minimal state intervention.

Trump with Musk and Milei, Source: X

Was Milei Duped?

As speculation over Milei’s role in the Libra debacle deepens, some allies argue that he may have been tricked. Local media quoted government sources suggesting that the real culprits were those within his circle, who failed to vet the project properly.

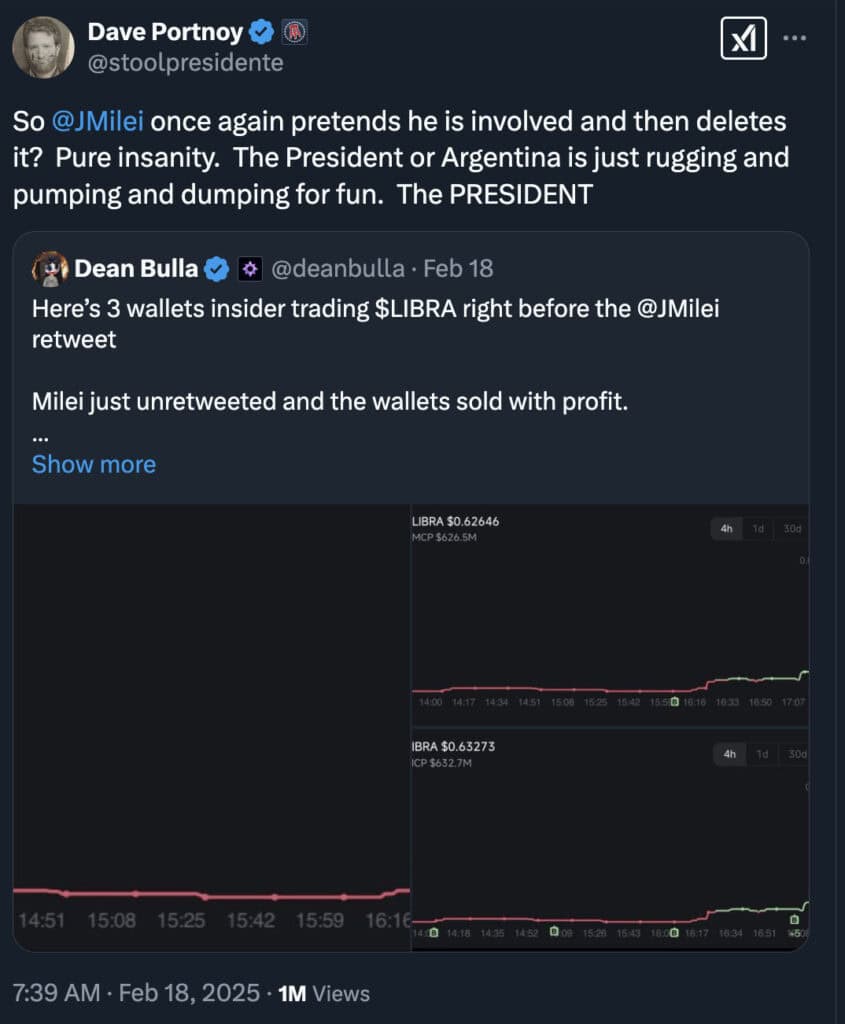

Adding fuel to the controversy, Hayden Davis, CEO of Kelsier Ventures, the firm behind Libra, made bombshell claims in an interview with Dave Portnoy of Barstool Sports. Davis asserted that the coin’s launch was orchestrated alongside Milei and his team—though he refused to name names.

Dave Portnoy is at the center of the meme coin mess, Source: X

Portnoy, who personally suffered heavy losses in the crash, didn’t mince words, calling Libra “the biggest rug pull of all time”. Davis later refunded him but insisted Milei wasn’t directly involved, instead blaming unnamed advisors within his inner circle.

“I don’t believe Milei is corrupt,” Davis said. “I don’t think he even fully understands what’s going on.”

Legal Storm: SEC Complaints and Criminal Investigations

Legal repercussions are already piling up. New York-based Burwick Law reported that hundreds of clients who lost money on Libra are exploring potential legal action. Meanwhile, Moyano & Asociados, an Argentine firm, has filed a complaint with the US Securities and Exchange Commission (SEC).

Back home, an Argentine judge has been assigned to more than 100 cases linked to the scandal. While opposition leaders have pushed for impeachment, the political math remains in Milei’s favor—for now.

Next Stop: Washington and the IMF

Despite the uproar, Milei is pressing ahead with his international agenda. On Wednesday night, he departs for Washington, hoping to meet Trump and secure US backing for an expanded IMF program—a key element in his bid to stabilize Argentina’s fragile economy.

He’ll also attempt to negotiate tariff exemptions under Trump’s new protectionist policies. But with the Libra scandal still making headlines, his ability to command credibility on the global stage is now under serious question.

For Milei, the crypto fallout is more than just a market hiccup—it’s a political reckoning that could redefine his presidency.

Meteora Co-Founder Steps Down Amid LIBRA Controversy

Meanwhile Ben Chow, co-founder of liquidity protocol Meteora, has resigned following allegations of involvement in a scheme to extract millions from memecoin launches, adding fuel to the ongoing scandal surrounding the LIBRA token.

Moty Povolotski, founder of DeFi Tuna, accused Kelsier Ventures—the market-making firm behind LIBRA—of orchestrating a sophisticated scheme to siphon funds from investors via Meteora’s memecoin staking platform, M3M3. He further alleged that Chow had facilitated a network of crypto influencers who reaped enormous profits at the expense of retail traders.

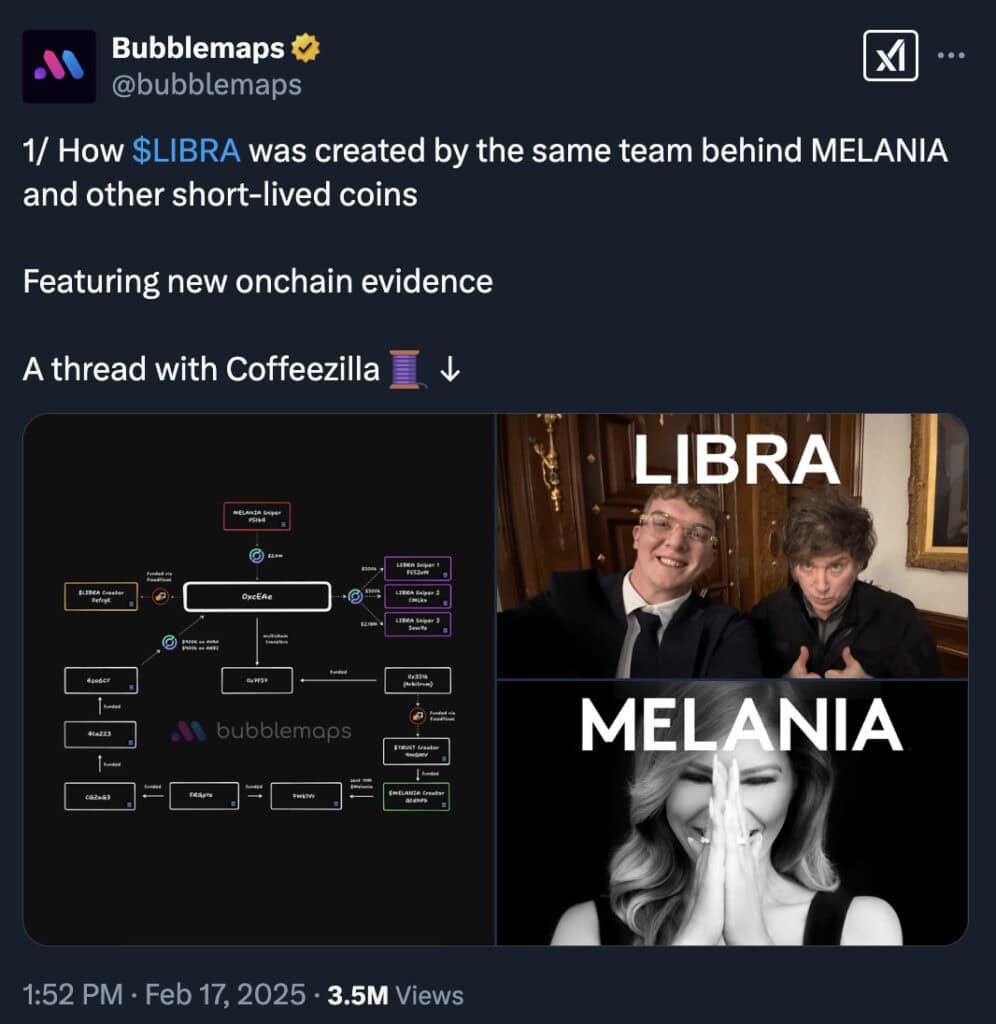

According to Povolotski, this was not an isolated incident. He claims similar tactics were deployed in previous memecoin launches, including MELANIA, MATES, and ENRON. His estimates suggest that over $200 million was funneled to insiders who had access to token mint addresses before launches, allowing them to front-run purchases and secure hefty profits.

On-chain evidence from Coffeezilla links the LIBRA team to the ill-fated MELANIA meme coin, Source: X

Chow has denied any direct financial involvement, stating, “I have never received or managed any tokens on the side.” However, Meteora’s pseudonymous second co-founder, Meow—who also leads Jupiter DEX—announced Chow’s resignation on X, citing concerns over his leadership.

“While I am 100% confident about Ben’s character, as a project lead he has shown a lack of judgment and care about some of the core aspects of the project, especially given its current size and reputation,” Meow wrote. “And this is unfortunately unacceptable.”

The controversy surrounding LIBRA deepened when the token—endorsed by Argentina’s President Javier Milei—was fast-tracked to a “verified” listing on Jupiter within an hour of launch. The exchange defended its decision, stating that LIBRA’s market cap had already reached $1.5 billion, justifying the verification as a protective measure for users.

Despite the growing scrutiny, Meow insists that neither Jupiter nor Meteora engaged in insider trading or received tokens improperly. To address concerns, Jupiter has enlisted the legal services of Fenwick & West—the same firm entangled in the FTX ($0.00) fraud case—to conduct an independent investigation and publish a formal incident report.

With reputations and investor confidence on the line, the findings of that report may determine whether this scandal is a bump in the road or a fatal blow for Meteora and its leadership.

Earlier this week Coffeezilla landed an interview with Hayden Davis (aka Kelsier), one of the four key figures behind $LIBRA, alongside Julian Peh (Kip Protocol), Mauricio Novelli (Tech Forum Argentina), and Manuel Godoy (Tech Forum Argentina). Notably, Javier Milei publicly endorsed LIBRA on February 14, 2025.

During the conversation, Davis openly admitted that the LIBRA team had sniped the launch of their own token, while the MELANIA team did the same for MELANIA. Watch the full interview below for the details.

Celebrity Meme Coins – A Road to Nowhere

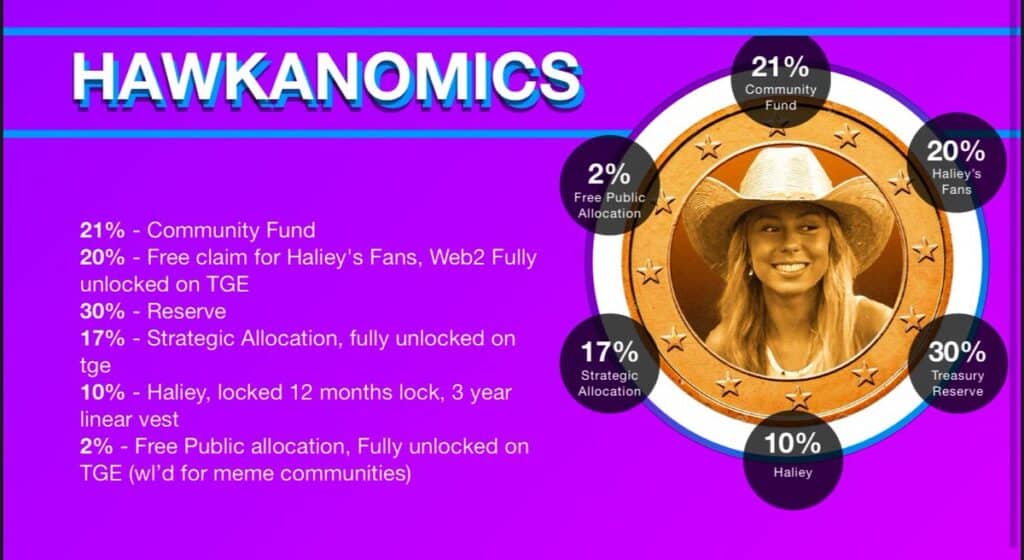

Celebrity-backed meme coins have frequently turned into high-profile debacles, with investors losing millions due to pump-and-dump schemes or poor project management. One recent example is Hawk Tuah (HAWK), a Solana-based memecoin launched in 2024 by Hailey Welch, a social media personality who went viral for a comedic interview clip.

The Tokenomics of HAWK turned out to be hot air as insiders dumped, Source: X

The token saw a rapid surge in price upon launch but quickly collapsed, with allegations of insider trading and liquidity manipulation surfacing. Similar cases include Caitlyn Jenner’s JENNER token, which raised eyebrows after blockchain sleuths uncovered suspicious wallet activity linked to insiders. Even Trump’s name wasn’t enough to keep the Trump meme coin price above water.

Rapper Iggy Azalea’s MOTHER coin also faced controversy, as critics accused her of cashing in on meme coin mania without offering any real utility. Even mainstream figures like Kim Kardashian and Floyd Mayweather have been fined by the SEC for promoting crypto projects without disclosure. These debacles highlight the volatile and often reckless nature of celebrity-endorsed cryptocurrencies, where hype frequently outweighs substance, leaving fans and investors holding the bag.