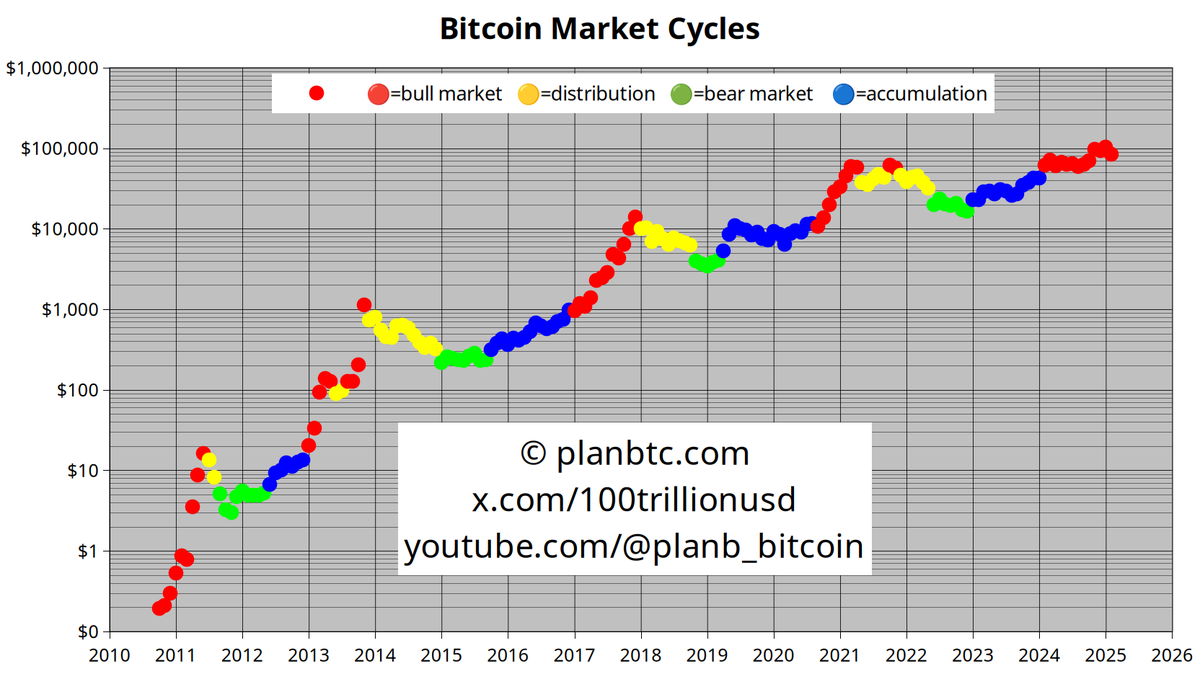

Widely followed quant analyst PlanB says Bitcoin’s (BTC ($88,137.41)) latest correction is now raising questions as to whether its bull cycle is on the verge of ending.

In a new strategy session, PlanB says that while on-chain data suggests Bitcoin remains in a bull cycle, a lack of new all-time highs since January may indicate a bear market is starting to form.

“Some questions about the Bitcoin market cycle chart. It is still measuring ‘bull market’ (red) in on-chain data. But as I explain in today’s video, we are at a crossroads.”

Source: PlanB/X

Source: PlanB/XThe analyst says there remains the potential of a V-shaped recovery after Bitcoin’s correction that tapped about $78,000 last week.

“In bull markets, we can have multiple dips that are 20% or even 30% minus. However, it was still an unexpected dip. I expected more all-time highs after January’s all-time high and I expected February to be an all-time high as well, above $102,000. So we’re really at the crossroads right now.

Either we’ll have a red hot bull market, a continuation of the bull market, or we enter the distribution phase into a bear phase. So what will it be? I don’t know. That’s a big question. Was this the top and is this the start of the bear market, or will we see a V-shape recovery and more bull market action?”

Source: PlanB/X

Source: PlanB/XBased on historic precedence, the analyst says Bitcoin is likely to rally from current prices and print new all-time highs.

“Yes, it has been at this crossroads each and every halving cycle. In all cycles the market has chosen bull/FOMO (fear of missing out) from here, but we have had only four cycles, not really enough to say something statistically sound. Fingers crossed for this fifth cycle.”

Bitcoin is trading for $84,377 at time of writing, down 6.5% in the last 24 hours.

Generated Image: DALLE3

The post PlanB Says Bitcoin Bull Market at New Crossroads Following Deep Correction – Here’s His Outlook appeared first on Crypto News Australia. creator solana token