XRP ($2.41)” decoding=”async” srcset=”https://bravenewcoin.com/wp-content/uploads/2025/02/Bnc-Feb-11-21-200×113.jpg 200w, https://bravenewcoin.com/wp-content/uploads/2025/02/Bnc-Feb-11-21-300×169.jpg 300w, https://bravenewcoin.com/wp-content/uploads/2025/02/Bnc-Feb-11-21-400×226.jpg 400w, https://bravenewcoin.com/wp-content/uploads/2025/02/Bnc-Feb-11-21-600×339.jpg 600w, https://bravenewcoin.com/wp-content/uploads/2025/02/Bnc-Feb-11-21-768×434.jpg 768w, https://bravenewcoin.com/wp-content/uploads/2025/02/Bnc-Feb-11-21-800×452.jpg 800w, https://bravenewcoin.com/wp-content/uploads/2025/02/Bnc-Feb-11-21.jpg 825w” sizes=” 300px) 100vw, 300px”>

XRP ($2.41)” decoding=”async” srcset=”https://bravenewcoin.com/wp-content/uploads/2025/02/Bnc-Feb-11-21-200×113.jpg 200w, https://bravenewcoin.com/wp-content/uploads/2025/02/Bnc-Feb-11-21-300×169.jpg 300w, https://bravenewcoin.com/wp-content/uploads/2025/02/Bnc-Feb-11-21-400×226.jpg 400w, https://bravenewcoin.com/wp-content/uploads/2025/02/Bnc-Feb-11-21-600×339.jpg 600w, https://bravenewcoin.com/wp-content/uploads/2025/02/Bnc-Feb-11-21-768×434.jpg 768w, https://bravenewcoin.com/wp-content/uploads/2025/02/Bnc-Feb-11-21-800×452.jpg 800w, https://bravenewcoin.com/wp-content/uploads/2025/02/Bnc-Feb-11-21.jpg 825w” sizes=” 300px) 100vw, 300px”>This initiative highlights SBI’s long-standing commitment to cryptocurrency adoption and blockchain technology in traditional finance.

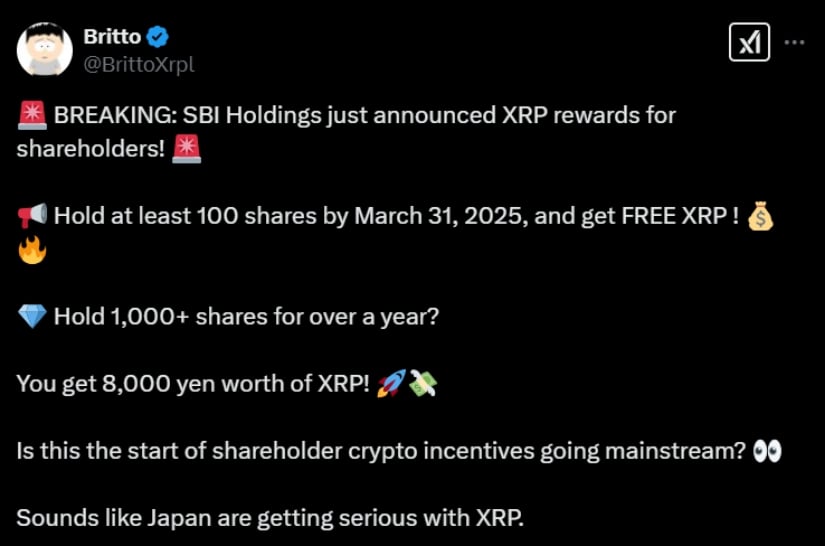

SBI Holdings has announced to pay its shareholders using XRP. Source: Britto via X

Through this program, eligible shareholders can choose between XRP or a selection of health and wellness products from SBI ALApromo Co., a subsidiary specializing in functional foods and cosmetics. The move aligns with SBI’s broader strategy of integrating digital assets into mainstream financial services.

How the XRP Rewards Program Works

SBI Holdings has set specific eligibility criteria for shareholders to participate in the rewards program. Investors listed on SBI’s shareholder register as of March 31, 2025, qualify for the benefits based on the number of shares they hold:

-

100 to 999 shares or at least 1,000 shares held for less than a year: Eligible for 2,000 yen worth of XRP or select health products.

-

1,000 or more shares held for over a year: Eligible for 8,000 yen worth of XRP or a wider selection of high-end cosmetics and wellness products.

In addition, all shareholders of less than 100 shares are given a 50% discount voucher for their purchases from SBI ALApromo.

Investors wanting to receive XRP are required to additionally be of Japanese nationality, 18 years old or more, and maintain an account at SBI VC Trade, the crypto trading platform of SBI, among other requirements. XRP will be distributed before July 31, 2025, in accordance with Japanese regulations.

SBI’s Strong Support for XRP and Ripple

SBI Holdings has always been quite vocal in support of Ripple and the XRP cryptocurrency, steadily building out blockchain-focused solutions within its financial ecosystem. It had already integrated Ripple’s technology into cross-border payment services, hence proving a belief in the asset’s utility.

SBI Holdings is once again offering XRP as a shareholder benefit, providing a coupon code for 2,000 yen worth of XRP, with distribution expected by July 31, 2025. Source: Crypto Eri via X

Crypto analyst Crypto Eri said of the latest move by SBI: “That would be a huge statement about their commitment to XRP.” The CEO of SBI Holdings, Yoshitaka Kitao, was similarly sanguine about the future of XRP – assuming regulatory hurdles globally let up.

“Once the court decides XRP is not a security, we expect a big price surge,” Kitao said, based on the expectation of further adoption.

XRP’s Growing Influence in Japan’s Banking Sector

SBI’s XRP rewards program comes at a time when Ripple’s influence in Japan is expanding. Over 60 Japanese banks, covering nearly 80% of the country’s banking sector, have partnered with Ripple to enhance cross-border transactions. This level of institutional support could fuel further adoption of XRP for real-world payments.

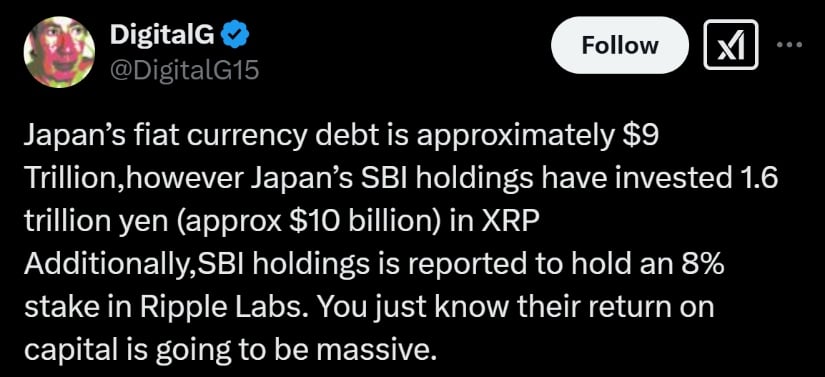

SBI Holdings invested $10 billion in XRP and owns 8% of Ripple, eyeing massive returns despite Japan’s $9 trillion debt. Source: DigitalG via X

Crypto analyst Gen Abilsav predicts that XRP’s price could surge depending on the extent of adoption. He outlined three potential scenarios:

-

Minimal adoption—only a few banks use XRP, pushing its price to $3–$5.

-

Moderate adoption—if half of Japan’s banks implement XRP, the price could rise to $10–$25.

-

Full adoption—if every bank integrates XRP, the price could reach $50–$100 or more, significantly boosting its market capitalization.

This projection underscores the potential impact of Japan’s banking sector on XRP’s market dynamics.

XRP ETF Approval Inches Closer

The table below shows the current ETF approval odds for various digital assets, as assessed by Bloomberg analyst James Seyffart. It details firms that have filed S-1s for spot asset ETFs, the first 19b-4 filing dates, whether the SEC has acknowledged these filings, and the projected final SEC decision deadlines.

The SEC’s current stance on whether each asset is considered a commodity is also included, which is a key factor influencing approval odds. Notably, Litecoin and Dogecoin have higher approval chances (90% and 75%, respectively), largely due to their likely classification as commodities.

Meanwhile, Solana, XRP, and Dogecoin face more regulatory uncertainty, reflected in slightly lower approval odds (70%, 65%, and 75%, respectively). The acknowledgment of filings for Litecoin and Solana suggests a smoother path toward potential approval, whereas XRP and Dogecoin are still awaiting acknowledgment. HBAR ($0.23) and Polkadot are in an even earlier stage, with no official filings or estimated odds yet, though analysts suggest they might have a chance depending on future regulatory developments.

The odds of an XRP ETF approval in 2025 are 65%, Source: James Seyffart via X

Market Trends and XRP’s Price Outlook

At the time of writing, XRP is trading at $2.43, following slight movements within the range of $2.26-$2.57. According to analysts, a breakthrough above the resistance line of $2.57 may push XRP to $2.96, while a slide below $2.26 might see it head toward $1.97.

Ripple (XRP) was trading at around $2.43, up 1.23% in the last 24 hours at press time. Source: XRP Liquid Index (XRPLX) via Brave New Coin

Meanwhile, on-chain activities flash signs of growing investor interest. According to CryptoQuant, the number of transactions on the XRP network jumped 12% after the recent correction to potentially indicate investor accumulation in case of a breakout.

A Step Toward Mass Adoption?

Ripple’s drawn-out legal battle with the SEC has taken some unexpected twists. One of the more intriguing shifts is the reassignment of Jorge Tenreiro, a leading figure in the SEC’s crypto enforcement unit and a key player in the Ripple case, to another department. This sudden personnel change has sparked speculation that the regulator might be easing its aggressive stance—potentially clearing the way for a more favorable outcome for Ripple.

However, XRP’s price hasn’t followed suit. Despite these legal shakeups, the token has dropped around 24% in the past week, currently hovering near $2.40. This decline is surprising, especially in light of what many consider positive legal momentum for Ripple. Analysts suggest that broader market forces are at play, particularly Bitcoin’s struggle to hold crucial support levels, which could be weighing down the XRP price. In February, XRP price predictions from analysts have softened while the market has cooled.

On the legal front, Ripple’s Chief Legal Officer, Stuart Alderoty, remains upbeat, suggesting that leadership shifts within the SEC could pave the way for more crypto-friendly policies. Legal experts also point to the SEC’s recent decision not to oppose Coinbase’s request for an interlocutory appeal, interpreting it as a potential sign of a softening stance on crypto cases.

SBI Holdings’ decision to reward shareholders with XRP highlights the growing intersection between traditional finance and digital assets. In addition to incentivizing investment, the offer of cryptocurrency as a tangible benefit normalizes the use of digital assets in corporate finance.

If Ripple continues to see uptake within Japan’s banking industry, this may be a case study for other financial institutions in Japan to integrate crypto rewards and payment areas.