Competitive intelligence (CI) has evolved beyond simple website monitoring and social media listening. Between unpredictable external events with ambiguous market impacts, consolidation of market cap into fewer stocks, and complicated geopolitical factors, competitive intelligence is more complex than ever before.

That’s why leading companies and firms are looking for competitive intelligence tools that give them access to premium, proprietary content sources that go beyond the publicly available, consumer-grade information that everyone else is monitoring. Additionally, organizations are discovering the value of advanced artificial intelligence (AI) search capabilities that filter through the noise to extract the most meaningful insights from data to increase the ROI from your research.

AlphaSense is a leading provider of competitive intelligence, including 10,000+ high-quality content sources that include company documents, expert calls, broker reports, news, and regulatory documents—all in a single platform.

In this blog, we cover the main sources of competitive intelligence that are crucial for staying ahead of the competition and for implementing successful CI strategies at your organization. We also discuss how to amplify the reach of your competitive intelligence through AI and automation, and how AlphaSense covers all these bases and more.

Company Documents

A key source of CI, company documents include SEC and global filings, earnings transcripts, company presentations, press releases, event transcripts and more.

AlphaSense provides access to all of the following company documents for hundreds of thousands of public companies and over 1.4 million private companies. Here’s how these sources can be used to glean crucial competitive insights:

Strategic Direction and Business Priorities

For CI, it’s important to understand a competitor’s strategy and where they are investing their resources. The following documents provide crucial insights on a company’s current performance, future outlook, and main business goals:

- Annual reports and company presentations – Companies disclose where they plan to spend most of their resources, what their strategic priorities are, and where the company is headed.

- Earnings transcripts – Provide real-time insights on a company’s current performance, challenges, and future outlook. Sentiment and tone are important factors here, which is why a tool like AlphaSense’s sentiment analysis is so helpful in understanding the subtext of what an executive is reporting, and how this is shifting over time.

Financial Performance

A company’s financial health provides important clues as to their overall performance and future outlook. The following documents are key for analyzing a competitor’s financial performance, profitability, and perceived threats:

- SEC filings (i.e. 10-K, 10-Q, 8-K) – Companies operating within the US submit these documents to the Security and Exchange Commission to report detailed financial data, including revenue breakdowns, profit margins, and cash flow statements. Sections like Risk Factors in 10-K filings can also provide valuable information about the company’s perceived threats, such as market competition, regulatory challenges, or supply chain disruptions.

- Global filings – These report the same information as SEC filings, but they are filed by companies outside the US to their respective international stock exchanges.

Sustainability Initiatives

Companies voluntarily release data on their environmental, social, and governance (ESG) practices to highlight their performance on various issues or adherence to specific sustainability reporting guidelines and benchmarks. These reports frequently help companies attract and retain customers and investors. Analyzing competitors’ reports can help with ESG benchmarking and identifying their strategic priorities.

- ESG reports – Companies file ESG reports to report on their sustainability initiatives, ethical sourcing practices, ethical hiring and employment practices, and governance.

Market Expansion and Growth Strategy

By tracking the following documents, you can get direct insights into competitors’ growth strategies, and then counteract with your own strategic initiatives:

- Press releases – Include announcements about new product launches, partnerships, or market entries.

- M&A announcements / integration plans – Provide insight into a competitor’s intent to expand market share, enter new markets, or acquire new capabilities.

Broker Research

Broker research and reports, also known as equity research or analyst reports, are a crucial source of competitive intelligence. These reports are created by analysts at brokerage firms and investment banks, and they contain important information on publicly traded companies, including financial forecasts, valuation assessments, and insights on industry trends and competitive positioning. Broker reports are crucial for staying ahead of market movements, building proactive business strategies, and getting the competitive edge.

AlphaSense provides access to research reports from 1,500+ research providers (comprising sell-side analysts, research teams, and strategists) that cover companies, industries, asset classes, and economies. Our proprietary offering is Wall Street Insights®, which is specifically geared toward our corporate users and features equity research from the world’s leading brokerage firms including, but not limited to:

- Goldman Sachs

- JP Morgan

- Morgan Stanley

- Cowen

- UBS

- HSBC

- Credit Suisse

Wall Street Insights® showcases both real-time and after-market research, is sourced from both broker partnerships and vendors, and covers North America, EMEA, APAC, and LATAM regions.

Here are some of the main types of broker reports that are useful for competitive intelligence, all of which can be found in the AlphaSense platform:

- Company reports – Periodically released over the course of an analyst’s or firm’s time covering a stock and include:

- Upgrades/downgrades: published when an equity analyst changes their opinion of a stock, and subsequently, their investment recommendation

- Estimate / price target revisions: published when an analyst revises their previous price target (their prediction of the future price of a security)

- Initiation reports: published when a broker first begins covering a company

- Credit research

- All other company reports

- Industry reports – Analyze a set of companies within the same industry

- Fixed income reports – Demonstrate maturity distribution of portfolios

- Economic/macro reports – Shares analysts’ views on growth expectations, inflation, stock market volatility, and global market trade

- Commodities reports – Provide analysis of commodities within a particular industry, published weekly or monthly

All of the above reports can be used for competitive benchmarking, monitoring key market trends, and staying ahead of market shifts and emerging threats or opportunities in your industry.

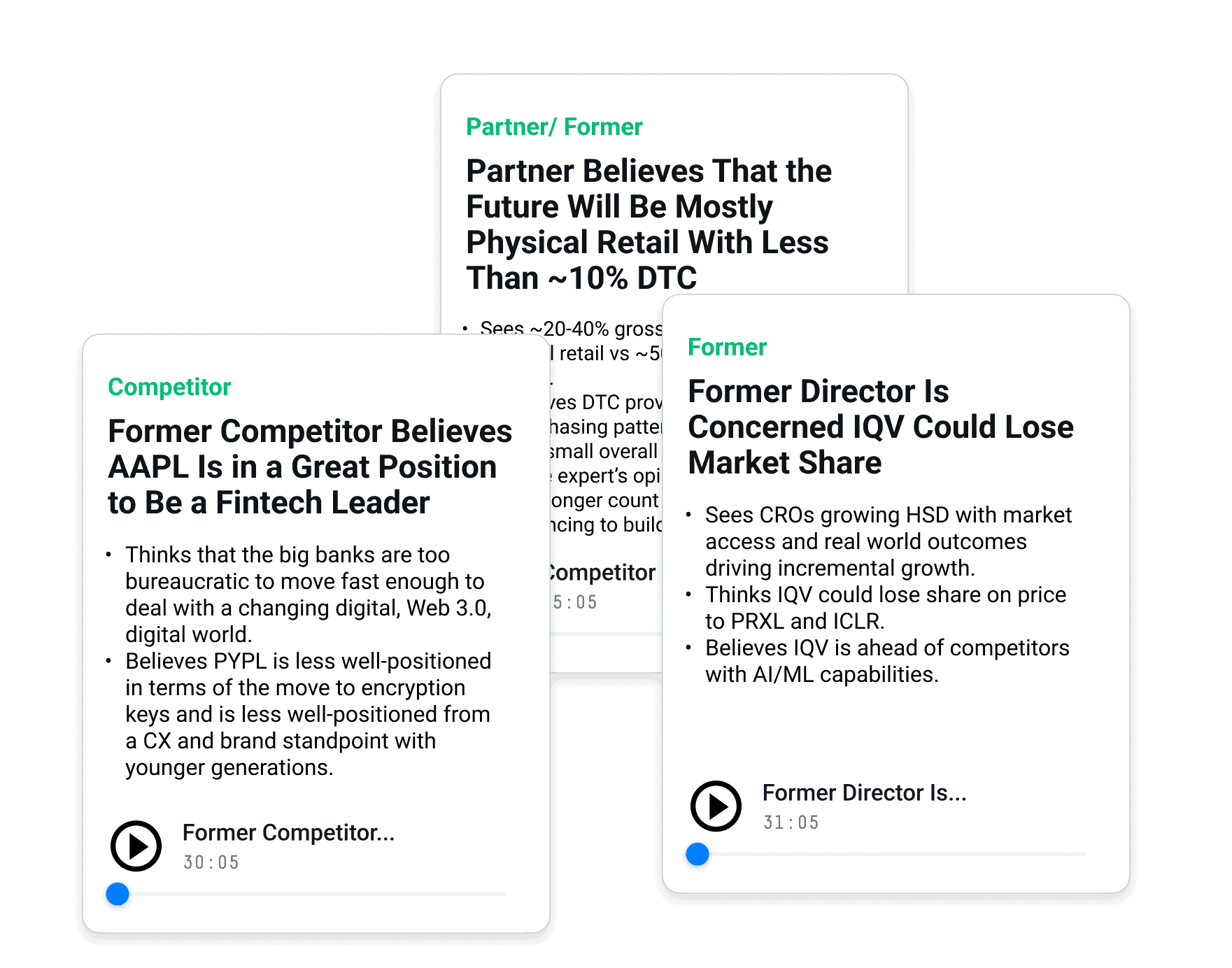

Expert Calls

Expert calls are a key source of competitive intelligence and a type of alternative data. Expert calls are a primary source that is a key complement to all the secondary sources that are integral for competitive intelligence, as they provide first-hand perspectives from former employees, executives, and customers of competitor companies. This can give you an inside look under the hood of your competitors’ operations, pain points, and strengths—which can then inform your company’s strategy.

Additionally, expert call services allow you to conduct your own 1:1 calls with the experts of your choice, so that you can ask them more specific and relevant questions regarding your competitors.

AlphaSense offers an extensive and fast-growing library of high-quality expert transcripts, and together with the recently acquired Tegus platform, provides hundreds of thousands of expert calls covering public and private companies across all industries and most regions. These calls provide deep insight into niche and highly regulated industries, and they provide valuable commentary on market or industry trends. This source is crucial for helping you stay ahead of the curve and your competition.

- Expert transcripts – Interviews conducted by analysts with thought leaders, partners, former employees, executives, and customers of different companies. These can be accessed by AlphaSense users through our proprietary Expert Insights library.

- Expert Call Services – Allow you to connect 1:1 with over one million pre-qualified expert profiles spanning all industries across the globe.

News and Trade Journals

News and trade journals are primarily used by companies to understand how the press is speaking about competitors, which provides insight into competitors’ market positioning, how they are perceived by the public, and what they are most known for.

AlphaSense provides access to top-tier news publications and trade journals for industries including healthcare, technology and telecommunications, financial services, real estate, industrials and materials, consumer products, aerospace and defense, automotive and transportation, and energy and utilities. You can find the following on the AlphaSense platform, spanning different industries and across the globe:

- News reports – Provide real-time updates on competitor activities and can reveal strategic moves such as product launches, market expansions or partnerships, and leadership changes.

- Trade journals – Provide insight into key industry trends and evolving market dynamics, while also highlighting thought leadership and regulatory updates for better understanding of specific industries and key players.

Regulatory Documents

Regulatory documents are an essential source of competitive intelligence, as they provide insights into competitors’ innovation priorities, product pipelines and approvals, and areas of research focus. AlphaSense provides access to all of the following documents, including patent data for the past 20+ years in the US and Europe (with APAC expansion coming in 2025).

AlphaSense also provides regulatory updates from leading global health and energy organizations including:

- Clinicaltrials.gov

- EU Clinical Trials Register

- FDA

- CDC

- EMA

- Federal Reserve Bank

- ESMA

- FAA

- DOD

- EASA

Intellectual Property and Innovation

While understanding what products competitors are patenting and getting approved is integral for CI, this type of data can be very difficult to search for and find in most platforms. Patents typically are not tagged to specific companies or industries on free patent search websites, and keyword search is limited to only exact keyword matches—leading to missing synonymous or relevant patents that don’t match an exact search.

Most free patent services fall short by not providing real-time notifications on patent updates or mobile-friendly options for competitive monitoring. AlphaSense offers a different approach that combines rich, reliable data with an unparalleled search experience that allows you to get the most value from that data. Get real-time alerts for new patent grants and applications from companies and industries of interest to you, and use our advanced filtering and search tools to unlock critical insights from patent data in less time.

- Patent filings – Provide insight into a competitor’s technological advancements, innovation priorities, and future product pipeline. This data is highly useful for identifying potential competitive threats and opportunities.

Regulatory Approval

For industries like healthcare and pharmaceuticals, regulatory approvals from organizations like the FDA and EDA provide important information on product launch timelines and delays. In these industries, tracking competitors’ drug development pipelines is critical for competitive positioning and market intelligence. Similarly, regulatory approval plays a critical role in the energy and financial services industries.

- Drug approvals – These documents include detailed information about competitors’ drug development, testing, manufacturing, and intended use. They are important for understanding competitive benchmarking and establishing market entry and positioning strategies.

- Clinical trial filings – These documents are submitted to regulatory bodies to initiate and manage trials for new clinical treatments. They typically include protocols, study designs, patient demographics, and outcomes.

How AlphaSense Takes Your Competitive Intelligence Further

In addition to providing access to all the aforementioned sources, AlphaSense saves you hours of research time by centralizing the insights you need and delivering them to you with intelligent, AI-based smart search technology—maximizing confidence and minimizing informational blind spots.

Here’s how AlphaSense’s AI and automation take your competitive intelligence to the next level:

Generative Search

Generative Search is a generative AI chat experience that transforms how users can extract insights from hundreds of millions of premium content sources. Our Generative Search product leverages insights sourced from our external content library (450M+ premium documents), as well as your internal content. It provides on-demand answers to all your market or investment research questions—faster than humanly possible, and always with citations to exact snippets from where the data was sourced. You can dig deeper into topics by asking Generative Search follow-up questions or choosing a suggested query.

Smart Summaries

This feature allows you to glean instant earnings insights (reducing time spent on research during earnings season), quickly capture company outlook, and generate an expert-approved SWOT analysis straight from former competitors, partners, and employees. All Summaries provide you with citations to the exact snippets of text from where the summaries are sourced—combining high accuracy with easy verification.

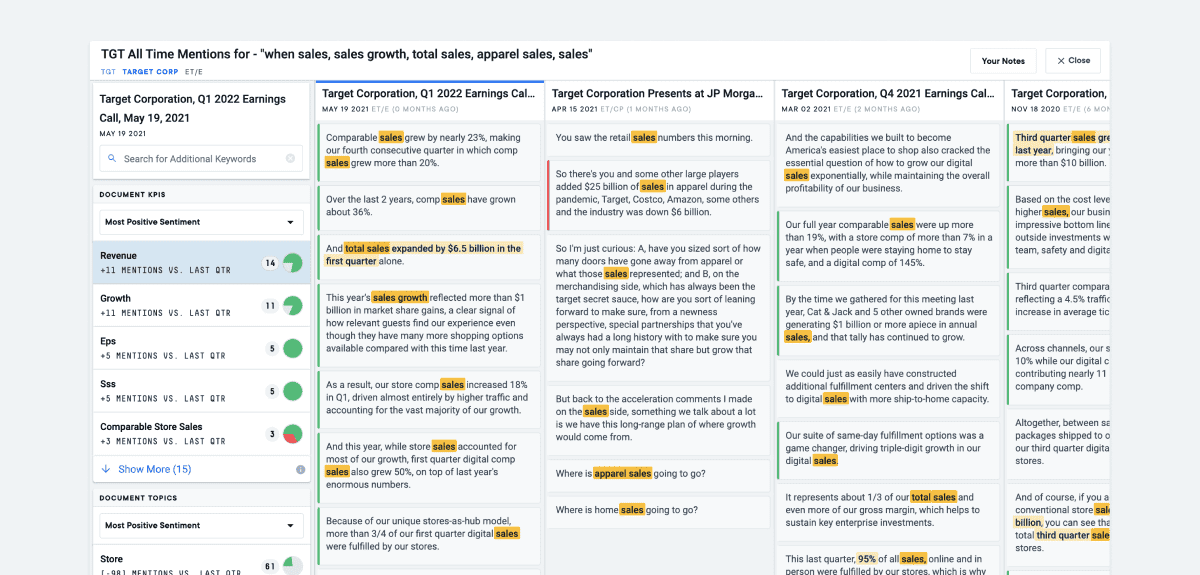

Smart Synonyms™

This unique feature is proprietary to AlphaSense and has the capability to understand both the keyword and search intent behind any of your queries, factoring in search results that include variations in business language. For example, a search for TAM will also bring back results on market size.

Relevancy Algorithm

AlphaSense’s advanced algorithm eliminates noise (i.e., content with matching keywords but ultimately irrelevant to your specific search objective) and surfaces only the most relevant results. This algorithm saves you precious time and energy, allowing you to get straight to analysis and other high-level tasks.

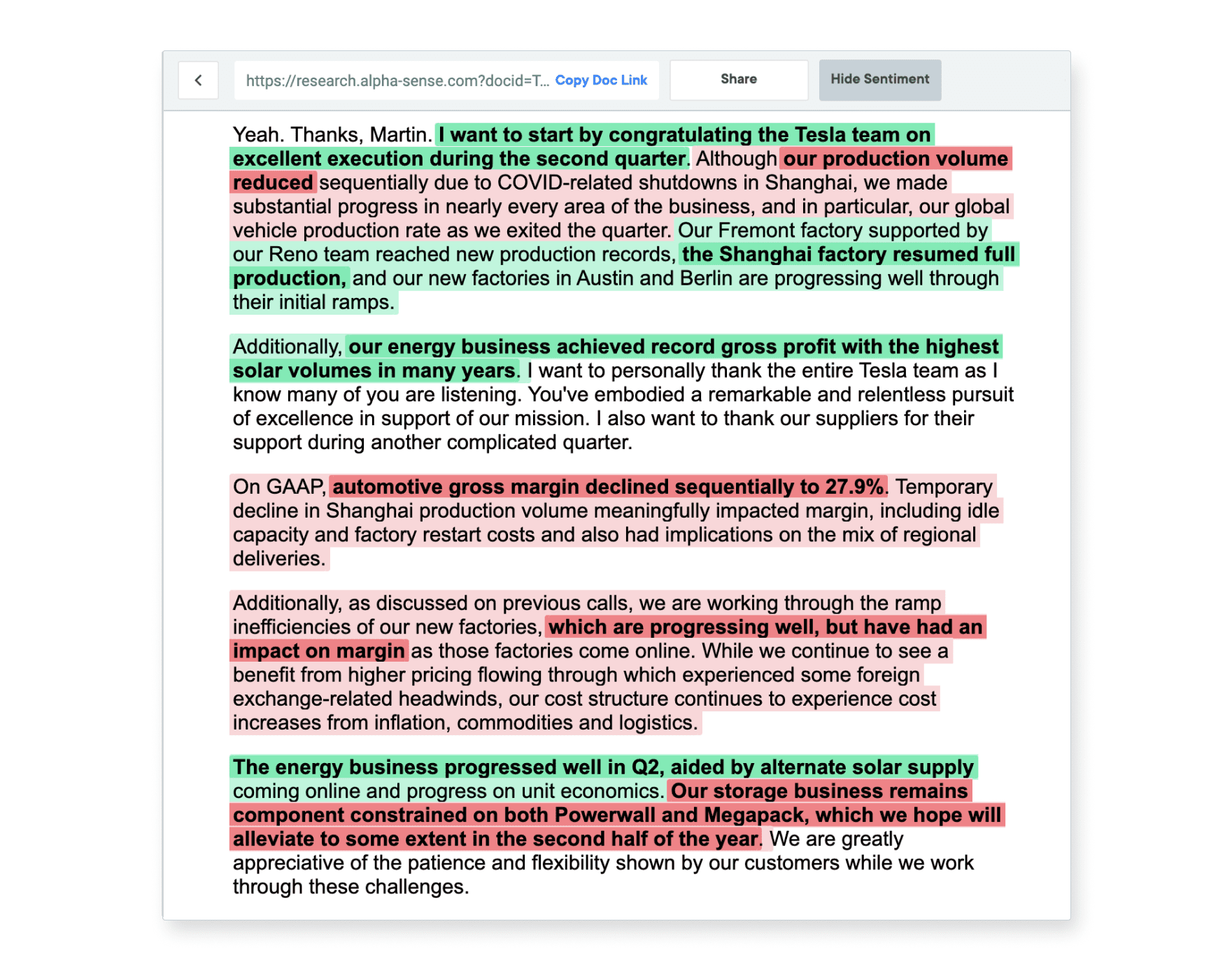

Sentiment Analysis

Sentiment analysis, a natural language processing (NLP)-based feature, parses through content and identifies nuances in the tone and subjective meaning of text. It then uses color coding to help readers identify the document’s positive, negative, and neutral sentiments.

This technology assigns each search term a numerical sentiment change score to help users track any slight change in market sentiments across time. Users can take advantage of it to make better-informed investment decisions and improve risk management strategies.

This feature can be instrumental in picking up on subtle sentiment shifts in expert interviews that go beyond expert-level commentary. But it can also be applied to company documents—such as earnings transcripts and company presentations—to gain much deeper insight into the perspective of an individual, company, or the market on a key topic.

Monitoring, Analysis, and Collaboration Tools

AlphaSense is designed to help users find insights faster. In order to do that, we offer a number of tools that extend beyond search and summarization to help accelerate research workflows.

- Customizable Dashboards create a centralized information hub for monitoring key companies and themes, while tailored real-time alerts provide real-time updates.

- Powerful collaboration tools like Notebook+ and commenting features help teams manage and share insights more effectively.

- Automated Monitoring allows you to set up real-time alerts that send instant updates on any relevant market movements, news, emerging trends, and competitor activities. We also generate snapshots of companies and topics regularly that keep you ahead of the curve with actionable insights.

- Table Tools allow you to streamline your quantitative analysis by enabling you to export modeled time-series data on company financials.

- Snippet Explorer allows you to effortlessly look at any topic or theme and all its historical mentions in a single view.

- Image Search allows you to discover insights buried in charts to quickly capture data without reading through pages of documents.

- Our Black-lining feature allows you to automatically identify any QoQ changes in SEC filings

Streamline and enhance your competitive intelligence with AlphaSense’s powerful combination of premium, differentiated content and cutting-edge AI search technology. Start your free trial today.