XRP ($2.69) Price Spikes on etf new” decoding=”async” srcset=”https://bravenewcoin.com/wp-content/uploads/2025/02/Screenshot-2025-02-21-at-9.24.17 AM-200×117.jpg 200w, https://bravenewcoin.com/wp-content/uploads/2025/02/Screenshot-2025-02-21-at-9.24.17 AM-300×176.jpg 300w, https://bravenewcoin.com/wp-content/uploads/2025/02/Screenshot-2025-02-21-at-9.24.17 AM-400×235.jpg 400w, https://bravenewcoin.com/wp-content/uploads/2025/02/Screenshot-2025-02-21-at-9.24.17 AM-600×352.jpg 600w, https://bravenewcoin.com/wp-content/uploads/2025/02/Screenshot-2025-02-21-at-9.24.17 AM-768×451.jpg 768w, https://bravenewcoin.com/wp-content/uploads/2025/02/Screenshot-2025-02-21-at-9.24.17 AM-800×469.jpg 800w, https://bravenewcoin.com/wp-content/uploads/2025/02/Screenshot-2025-02-21-at-9.24.17 AM-1024×601.jpg 1024w, https://bravenewcoin.com/wp-content/uploads/2025/02/Screenshot-2025-02-21-at-9.24.17 AM.jpg 1176w” sizes=” 300px) 100vw, 300px”>

XRP ($2.69) Price Spikes on etf new” decoding=”async” srcset=”https://bravenewcoin.com/wp-content/uploads/2025/02/Screenshot-2025-02-21-at-9.24.17 AM-200×117.jpg 200w, https://bravenewcoin.com/wp-content/uploads/2025/02/Screenshot-2025-02-21-at-9.24.17 AM-300×176.jpg 300w, https://bravenewcoin.com/wp-content/uploads/2025/02/Screenshot-2025-02-21-at-9.24.17 AM-400×235.jpg 400w, https://bravenewcoin.com/wp-content/uploads/2025/02/Screenshot-2025-02-21-at-9.24.17 AM-600×352.jpg 600w, https://bravenewcoin.com/wp-content/uploads/2025/02/Screenshot-2025-02-21-at-9.24.17 AM-768×451.jpg 768w, https://bravenewcoin.com/wp-content/uploads/2025/02/Screenshot-2025-02-21-at-9.24.17 AM-800×469.jpg 800w, https://bravenewcoin.com/wp-content/uploads/2025/02/Screenshot-2025-02-21-at-9.24.17 AM-1024×601.jpg 1024w, https://bravenewcoin.com/wp-content/uploads/2025/02/Screenshot-2025-02-21-at-9.24.17 AM.jpg 1176w” sizes=” 300px) 100vw, 300px”>This move signals growing institutional interest in XRP-based investment products and has fueled optimism about the cryptocurrency’s long-term prospects.

SEC Advances XRP ETF Filings

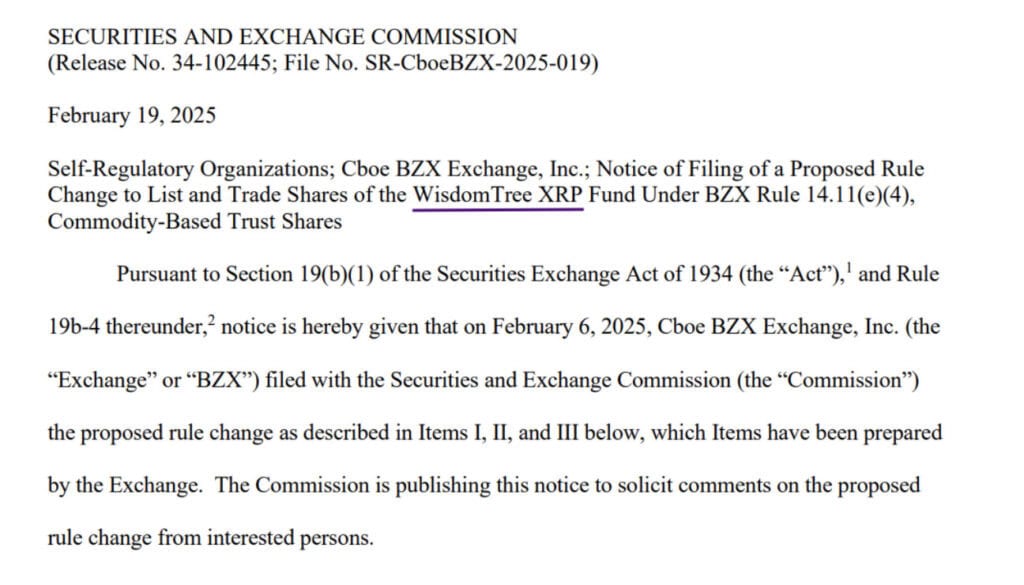

SEC acknowledges WisdomTree XRP ETF filing. Source: SEC.Gov

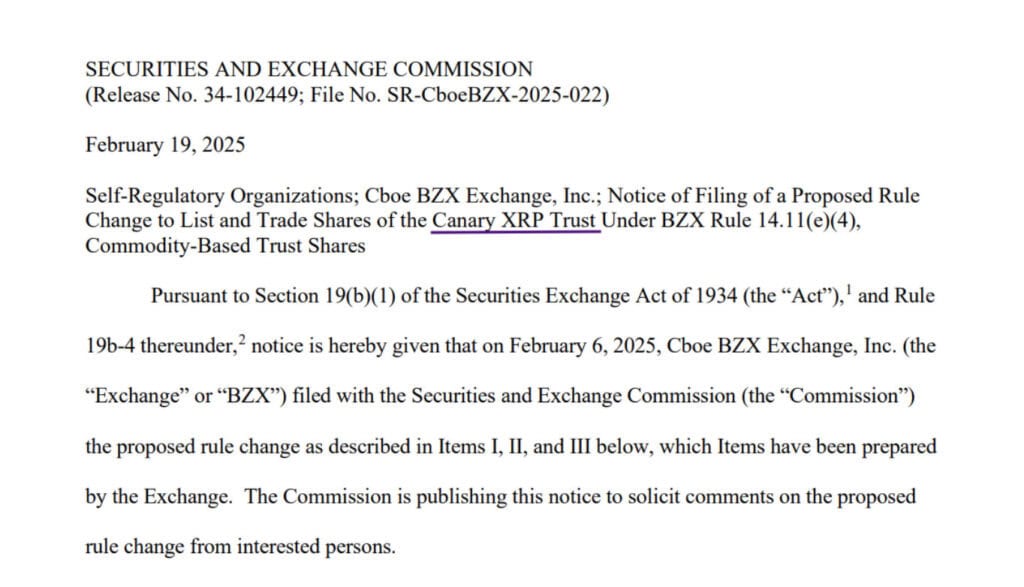

On Feb. 19, the SEC officially noticed spot XRP ETF applications filed on behalf of asset managers CoinShares, Canary, and WisdomTree by Nasdaq and Cboe BZX. The procedural step sets in motion a 21-day period of public comment within which the SEC has up to 240 days to approve or reject the filings.

SEC acknowledges Canary XRP ETF filing. Source: SEC.Gov

The move comes after the SEC recently approved Grayscale and Bitwise‘s XRP ETF filings. While approval of spot Bitcoin ETFs earlier this year opened the door, the SEC remains uncertain about XRP ETFs, considering that its lawsuit with Ripple continues to unfold.

XRP Price Responds to Growing Institutional Interest

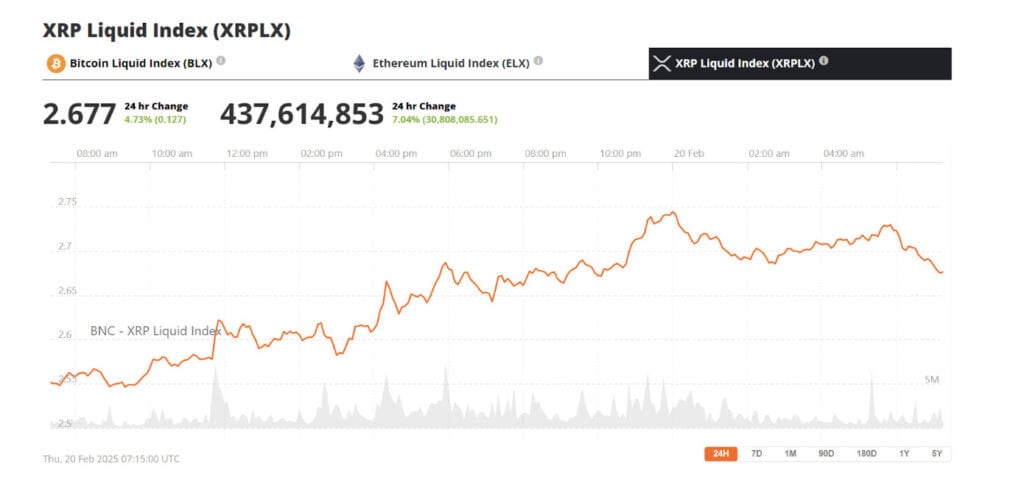

Following the SEC’s acknowledgment of the filings, XRP gained 6%, breaching $2.70 temporarily for a while in the early Asian trading session on Thursday. The upsurge reflects better investor sentiment, and analysts have reasoned that a move above crucial levels of resistance has the potential to propel XRP to its seven-year peak at $3.40.

Ripple (XRP) was trading at around $2.67, up 4.73% in the last 24 hours at press time. Source: XRP Liquid Index (XRPLX) via Brave New Coin

Technical indicators such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) indicate bullish strength. If XRP remains above the support line of $2.55 and can break the resistance level of $2.72, experts believe that it will gain more momentum.

Legal Uncertainty Looms Over SEC Ruling

Even as the approval of XRP ETF applications is good news, the current legal battle of the SEC against Ripple could influence the final decision. The SEC has delayed some enforcement cases in cryptocurrency during Acting Chair Mark Uyeda’s tenure. The agency has yet to provide any indication of whether it would drop its appeal of Judge Analisa Torres’s ruling in favor of Ripple.

Legal professionals, including Fox Business journalist Eleanor Terrett, have described that the SEC is prioritizing the cases with imminent deadlines and Ripple’s April 16 next court filing. This has created speculation that dramatic developments in the case may not be witnessed until then.

Brazil Approves First Spot XRP ETF

While the U.S. awaits regulatory clarity, asset manager Hashdex has secured approval from Brazil’s securities regulator to launch the world’s first spot XRP ETF. This milestone highlights international demand for XRP-based investment products and could pave the way for similar offerings in other jurisdictions.

Hashdex secures approval to launch the world’s first XRP spot ETF in Brazil. Source: Amelia via X

Hashdex’s approval follows a trend of increasing global acceptance of cryptocurrency ETFs. With multiple XRP ETF applications now under review in the U.S., investors are watching closely to see if the SEC will follow suit.

Market Outlook: XRP’s Path to $3.40 and Beyond

XRP’s success in holding onto its recent gains will rest on several factors, such as ETF approval potential, legal clarity, and wider market conditions. If the SEC eventually approves a Ripple XRP ETF, analysts estimate it could push institutional inflows and push XRP to fresh highs.

XRP challenges $2.80 resistance, targeting $3.40 amid a bullish setup, with key support at $2.50. Source: Crypto Champ via X

Conversely, a lengthy legal battle or regulatory challenges could delay XRP’s momentum. Still, with growing institutional interest and increasing global adoption, cryptocurrency remains a hot issue in the evolving digital asset landscape.

As the SEC’s 240-day review period begins, XRP investors will be closely monitoring regulatory developments and price movements in anticipation of a potential breakout.